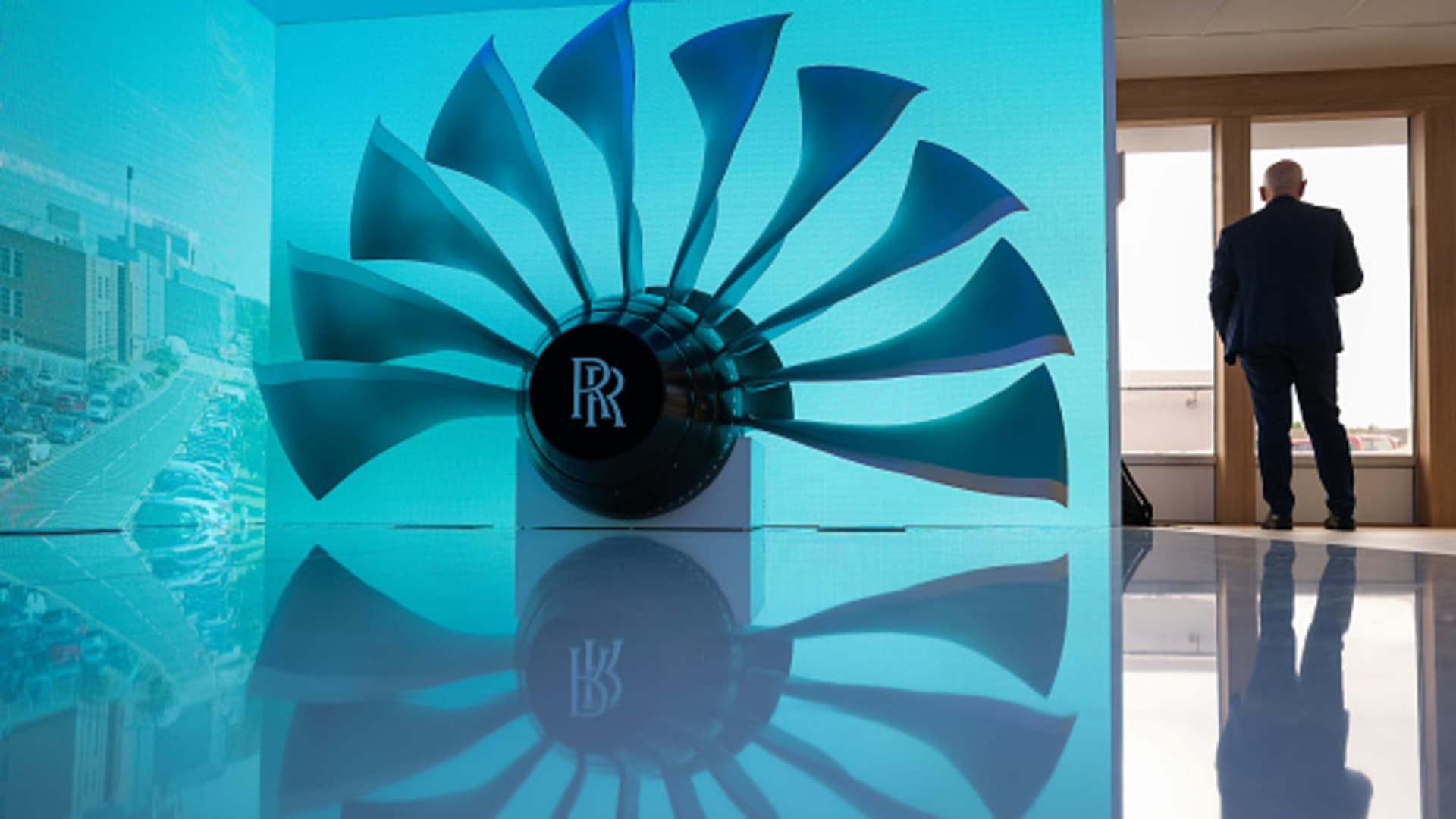

An UltraFan model was showcased at the Rolls-Royce Holdings Plc exhibit during the Farnborough International Airshow in Farnborough, UK, on Tuesday, July 23, 2024.

Photo Credit: Bloomberg | Getty Images

The British aerospace firm Rolls-Royce announced on Thursday its full-year earnings exceeded expectations. The company also raised its mid-term outlook and executed a £1 billion ($1.27 billion) share buyback plan.

Specializing in jet engine production for commercial aviation, as well as power systems for maritime and underwater vehicles, Rolls-Royce reported an impressive operating profit of £2.46 billion for 2024. This figure surpassed analyst forecasts and marks a substantial 57% increase compared to the previous year.

The firm attributed its upgraded targets to strong delivery performance in 2023 and early 2024, projecting operating profits to rise between £3.6 billion and £3.9 billion in the coming years.

In addition, Rolls-Royce reinstated a dividend of 6 pence per share after a five-year hiatus and announced that its £1 billion share buyback would proceed throughout 2025.

As a result of this announcement, Rolls-Royce stock surged nearly 16%, reaching a new 52-week high and topping the pan-European Stoxx 600 index. At 9:03 a.m. London time, the share price had increased approximately 15.3%.

During an interview on CNBC’s “Squawk Box Europe” on Thursday, Rolls-Royce’s CFO Helen McCabe stated, “We are two years into a multi-year transformation journey and have made significant progress.” She highlighted that this advancement reflects the company’s commitment to fulfilling its promises and showcases improving financial health and growth potential.