Apple has introduced a new affordable iPhone that packs a significant upgrade under the hood. This isn’t about the AI capabilities; it’s about the iPhone 16e’s binned System on Chip (SoC), showing that Apple could enhance features in older devices if it chose to. The focus here is on a key component that often goes unnoticed—its modem.

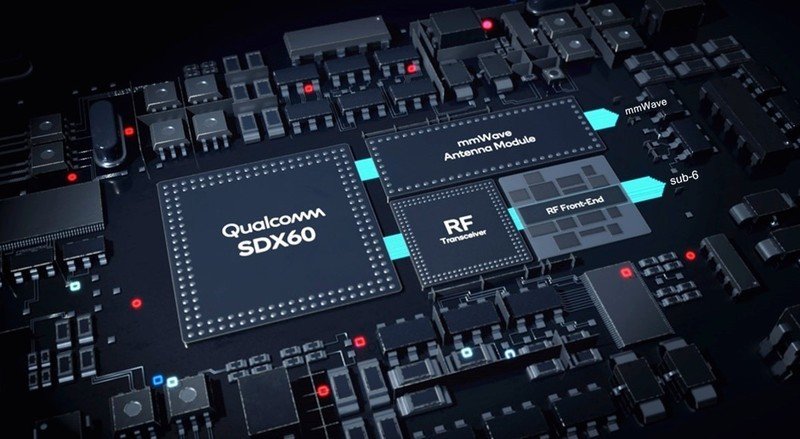

The iPhone 16e is the inaugural device to incorporate Apple’s proprietary C1 5G modem, which the tech giant developed following substantial investments in research and development, including the acquisition of Intel’s 5G division. However, this modem does not quite match the performance metrics of Qualcomm’s offerings, at least not on paper.

This is an important development because Apple’s C1 modem lacks support for millimeter-wave 5G frequencies. Consequently, two major issues arise: first, users will not experience the ultrafast 5G speeds that have been widely advertised, and second, in many areas, network coverage may be inadequate, prompting a fallback to LTE (4G).

The limitations stem from the fact that much of the technology integral to millimeter-wave modems comes from Qualcomm. This company either originated or significantly improved this technology, thus making it prevalent in North America. It seems that while Apple may have licensed various network technologies from Qualcomm, it may have decided against investing in enhanced millimeter-wave capabilities or found Qualcomm’s licensing fees unsatisfactory.

While I don’t possess any particular bias toward Apple products, I find this situation concerning. One might conclude that Apple’s move suggests it has outgrown its dependency on Qualcomm, which could imply that other manufacturers might follow suit as well. However, this is only applicable if they’re willing to compromise on performance while missing features that are commonly available across various price tiers.

The reality is that even Apple—an enterprise with ample resources—has not been able to shake Qualcomm’s dominance in the North American market.

Details concerning the development process or licensing terms remain elusive, making it difficult to determine why Apple opted to omit millimeter-wave 5G technology. This was undoubtedly a thoughtful choice, as Apple wouldn’t want its budget model to underperform compared with alternatives like the $300 OnePlus Nord in terms of connectivity, yet that may happen in cities such as New York or Chicago.

Apple has expressed intentions to extend the use of the C1 modem to additional models in its product range. I anticipate that the company will find a means to incorporate millimeter-wave capabilities before this occurs.

One undeniable factor is the complex relationship between Apple and Qualcomm, as evidenced by their history of litigation and partnership, which likely played a role in this decision. With competitors like Samsung and its Exynos 5G modems emerging, it’s clear that there’s more to cellular technology than just millimeter-wave capabilities. Nevertheless, there is no denying Qualcomm’s superior execution in this arena.

Qualcomm produces an impressive array of products, highlighting its market strength. It’s disheartening to observe the level of control one company holds, enabling it to suppress competitors or impose hefty fees for licensed technologies. If both Intel and Apple have struggled to challenge this dominance, then who has the means to do so?