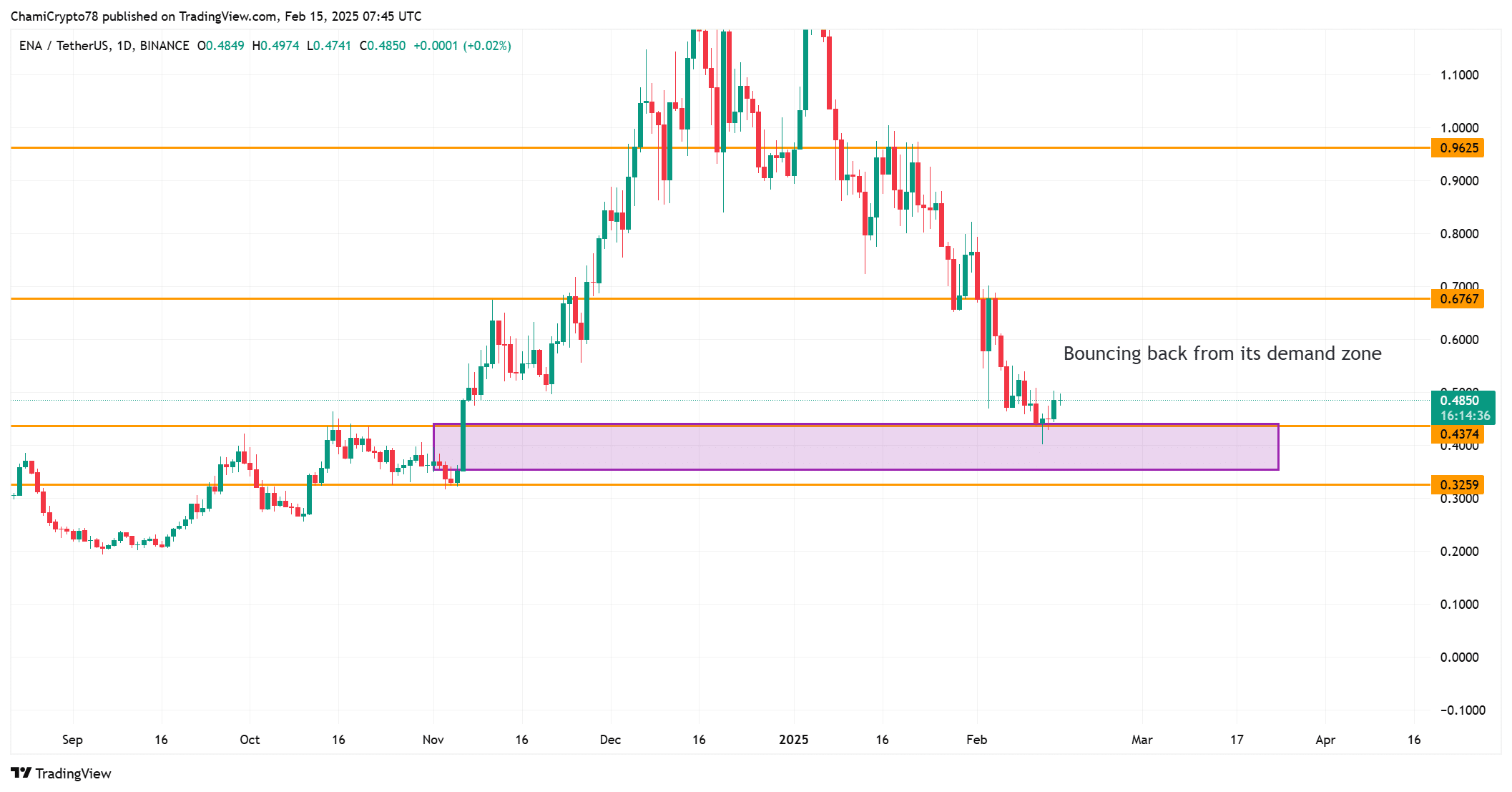

- Ethena (ENA) recently generated a buy signal, indicating potential upside as it tests critical resistance levels and its demand zone support.

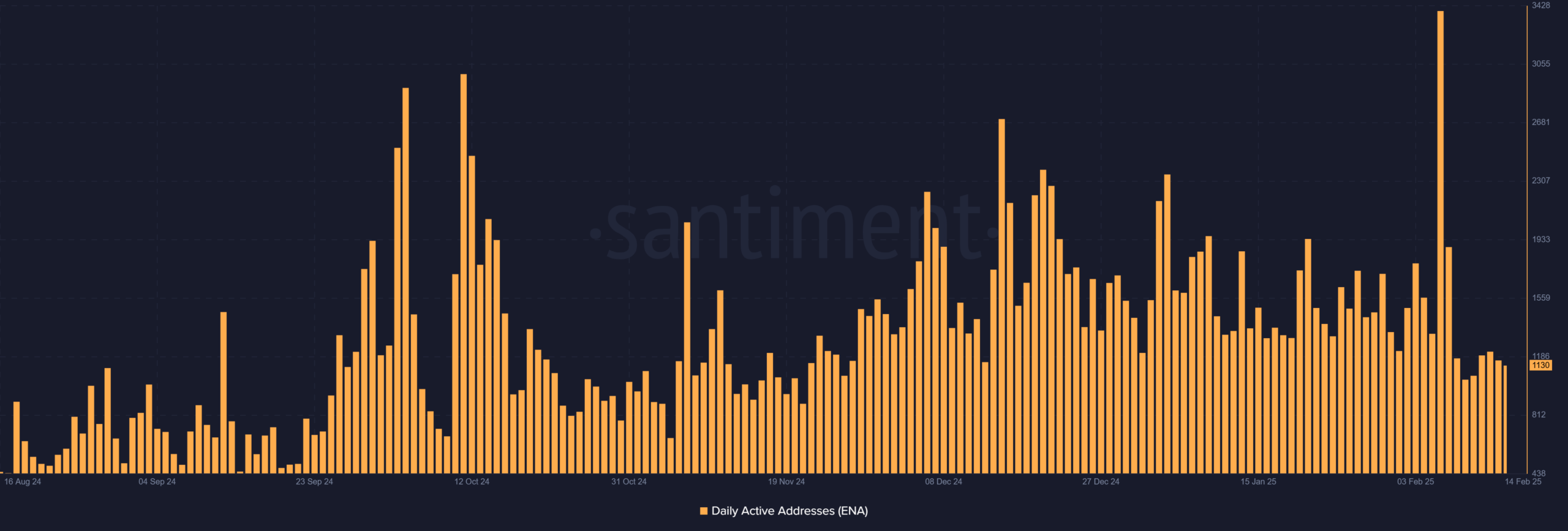

- Growth in daily active addresses and transaction volume indicates moderate interest in the asset.

Ethena [ENA] has recently triggered a buy signal on the 12-hour chart, as indicated by the TD Sequential indicator, suggesting a possible recovery following a decline. As of the latest update, ENA is trading at $0.4838, reflecting a gain of 4.49% over the last 24 hours.

Despite this positive technical indicator, the path forward is laden with resistance points that could impede the asset’s upward trajectory. Investors are keeping a close eye on these critical barriers to see if ENA can break through and sustain its bullish trend.

What are the key resistance levels for Ethena?

Currently, ENA is rebounding from its demand zone, situated around $0.4374, which appears to be providing support following the recent price drop. However, the next significant resistance level is anticipated at approximately $0.5249, which could prove to be a considerable hurdle for the asset.

If ENA can exceed this resistance, the next challenge will be around $0.6770. These resistance points will be pivotal in determining the sustainability of the ongoing bullish trend.

In fact, to achieve a more extended rally, ENA must effectively break through these crucial levels.

Analyzing Daily Active Addresses

Daily active addresses for ENA reached a peak of 1130, indicating moderate user engagement. This rise suggests increasing interest in ENA, although it is progressing at a steady rate. Consistent network activity could contribute to a more bullish sentiment if it continues over time.

Nonetheless, this increase alone does not guarantee further price gains unless supported by other metrics, such as transaction volumes. Therefore, the ongoing growth in active addresses may be indicative of a foundation being laid for potential future price appreciation.

Do Transactions Support Ethena’s Growth?

Transaction counts for ENA also showed a moderate rise, clocking in at 1120. While this increase is not colossal, it signifies steady demand for ENA. As the price ascends, heightened transaction activity could provide the necessary momentum to push through key resistance levels.

However, a drop in transaction volume could hinder the price’s ability to maintain its upward momentum. Thus, transaction activity will be a crucial factor in supporting ENA’s price in the short term.

In/Out of the Money – A Favorable Outlook for Bulls?

With ENA priced at $0.4838, approximately 70% of Ethena holders are “in the money,” enjoying profits on their investments. This scenario bodes well for potential bullish momentum, as a higher percentage of holders may choose to stay invested if prices continue to rise.

Conversely, the number of addresses that are “out of the money” appears relatively low, suggesting that sellers are likely to remain cautious and may wait for higher prices to sell.