According to Bloomberg, DeepSeek’s advancements in artificial intelligence are spurring a shift of investment funds back into Chinese markets, away from India.

Most Popular on Bloomberg

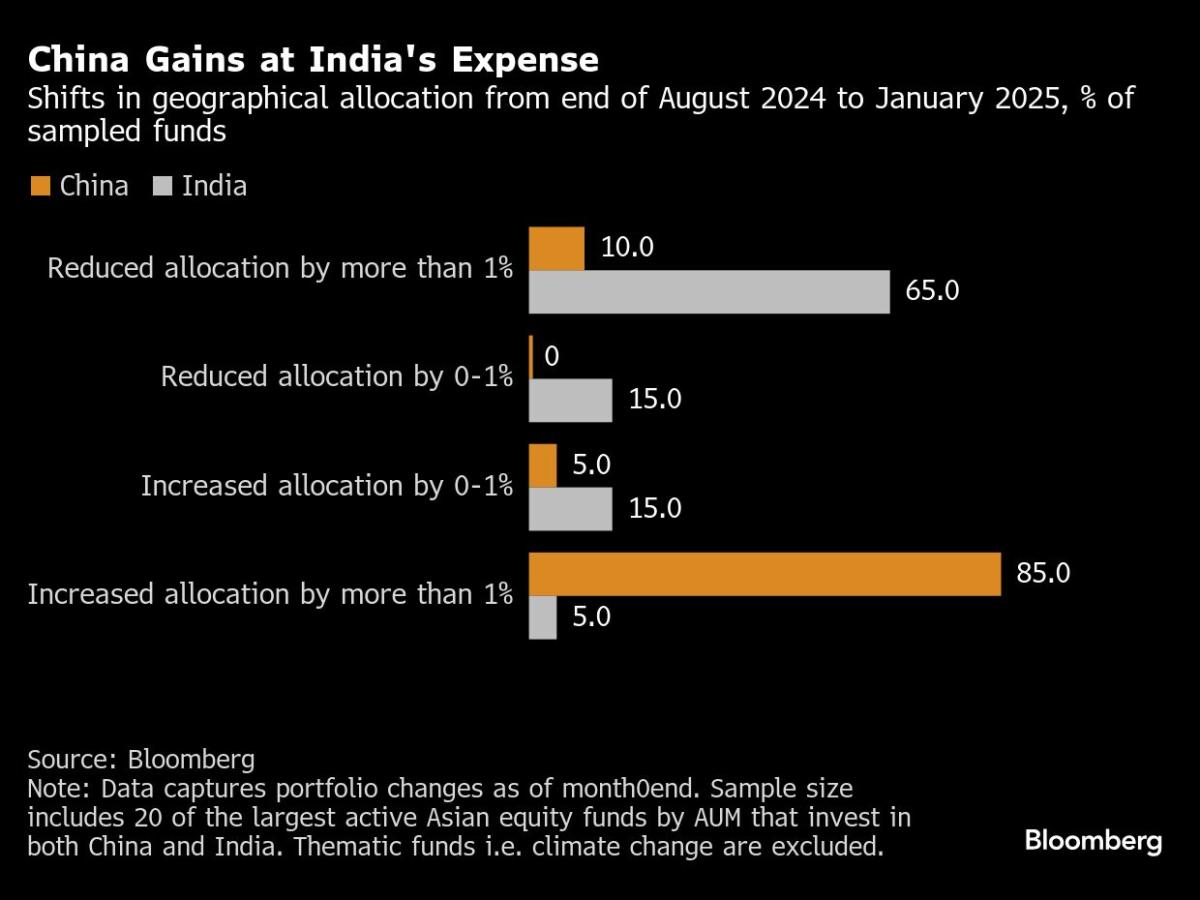

Hedge funds are increasingly turning towards Chinese equities, marking the fastest influx of capital in recent months. This surge is driven by optimism surrounding the technology revival linked to DeepSeek, alongside expectations for further economic incentives. Meanwhile, India’s market faces significant outflows due to concerns over declining macroeconomic growth, lackluster corporate earnings, and high stock valuations.

Over the last month, both China’s onshore and offshore equity markets have gained more than $1.3 trillion in total valuation. Conversely, India’s market has contracted by over $720 billion. The MSCI China Index is poised to outperform its Indian counterpart for the third consecutive month—its longest streak of this kind in two years.

“DeepSeek has demonstrated that China houses companies integral to the AI ecosystem,” stated Ken Wong, an Asian equity portfolio expert at Eastspring Investments. His firm has been increasing its holdings in Chinese technology firms while reducing investments in smaller Indian companies that had inflated beyond realistic valuations.

This transition signifies a reversal from the previous years’ trend where funds gravitated towards India, drawn by its substantial infrastructure investments and potential as an alternative manufacturing center to China. India had also been viewed as a relatively safe option amid the tariff initiatives proposed by Donald Trump.

China appears to be reclaiming its attractiveness, thanks to a renewed analysis of its investment potential, particularly in the technology sector. After previously alarming investors with regulatory crackdowns, Beijing may now support the burgeoning AI narrative, as evidenced by invitations extended to entrepreneurs like Alibaba Group’s co-founder Jack Ma to meet with top national officials.

Developments linked to DeepSeek are expected to bolster both China’s economy and its markets, enhancing the overall investment environment, according to Vivek Dhawan, a fund manager at Candriam. “Considering all factors, China currently offers a more compelling risk-reward ratio compared to India,” he added.

The difference in valuations further enhances China’s attraction. Currently, the MSCI China Index trades at approximately 11 times projected earnings, while the MSCI India Index is at around 21 times.