Coinbase’s Bold Strategy in the Stablecoin Market

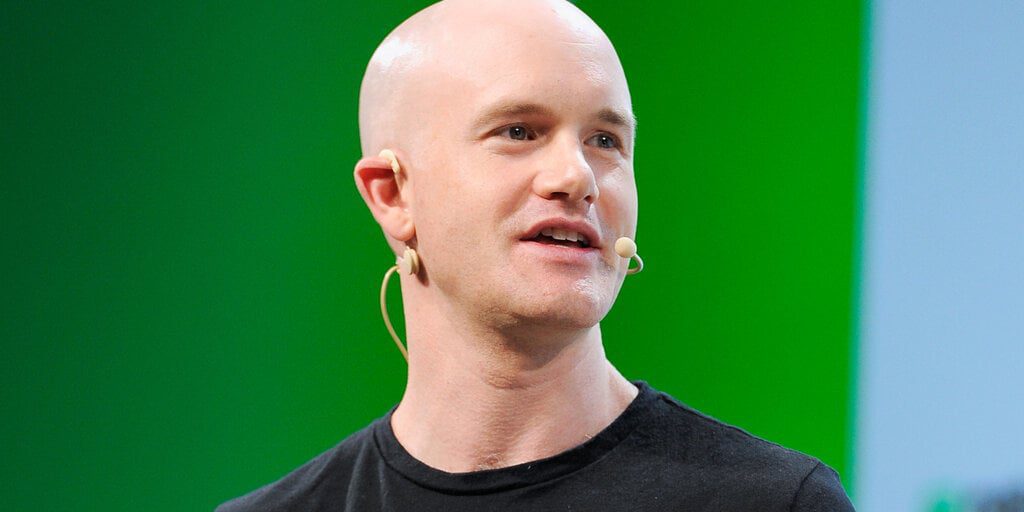

Brian Armstrong, the CEO of Coinbase, announced on Thursday that the cryptocurrency giant is ready to intensify its efforts in the competitive stablecoin arena.

During the fourth-quarter earnings call, Armstrong revealed the company’s intent to challenge Tether’s dominance as the leading stablecoin issuer. The primary objective is to elevate Circle’s USDC to the position of the world’s foremost dollar-backed stablecoin.

He described this ambition as a "stretch goal," indicating that while it is an ambitious target, it remains within reach and will require Coinbase to venture beyond its conventional boundaries.

Currently, USDC holds the position of the second-largest stablecoin, with a market capitalization of $56 billion, following a record peak last week. However, USDC still has substantial ground to cover as it seeks to surpass Tether, which commands a massive 60% of the stablecoin market at a staggering $142 billion, according to CoinGecko.

Given that stablecoins are pegged to another currency—specifically the U.S. dollar—their market cap is a reliable measure of their issuance.

Coinbase’s CFO, Alesia Haas, clarified Armstrong’s ambitious statement, emphasizing that the firm aims to accomplish this goal over the next few years.

This high standard for Coinbase comes on the heels of a remarkable fourth quarter, during which the company reported profits of $1.3 billion. Concurrently, momentum is building around stablecoin regulations on Capitol Hill, after a prolonged period of disagreement among lawmakers.

Senator Tim Scott (R-SC), who leads the Senate Banking Committee, has promised that legislation concerning stablecoins will be passed within the first 100 days of President Donald Trump’s administration.

This proposed legislation, known as the GENIUS Act, aims to pave a legal pathway for issuers of U.S. dollar-backed stablecoins. It would necessitate regular audits to ensure the health of the fiat reserves backing these products, according to a draft reviewed by Decrypt.

However, it’s uncertain how comprehensive any future stablecoin legislation will be and how it might affect USDC or USDT, as lawmakers may modify the bill before it progresses through both chambers of Congress and receives presidential approval.

Evaluating the Impact of Regulation

Just hours before Coinbase’s earnings call, analysts from JP Morgan suggested that Tether may need to alter the structure of its dollar-equivalent reserves that back the USDT stablecoin.

In their most recent attestation report, Tether disclosed that its reserves are primarily composed of cash and cash equivalents, alongside short-term deposits, including U.S. Treasuries and money market funds, which constitute 82% of its assets.

Historically, Tether has intermittently released these attestation reports regarding its reserves, though critics—including accountants and competitors—have pointed out that none of these financial documents have undergone formal audits.

While audits aim to reveal vulnerabilities and compliance issues by compiling data, attestations generally serve to validate the accuracy of that information.

It’s notable that Circle, like Tether, has yet to release an audited report on the reserves supporting the USDC. The company also issues attestations regarding the “highly liquid fiat reserves” backing USDC and EUROC, its Euro-backed counterpart.

JP Morgan has speculated that Tether might need to divest a significant portion of "non-compliant" assets from its reserves, such as Bitcoin and any residual commercial paper, to align with forthcoming U.S. regulations.

In response, Tether’s spokesperson contended that $20 billion in "other very liquid assets" had been overlooked, as well as over $1.2 billion in quarterly profits derived from substantial holdings of government debt.

Additionally, Tether’s recent relocation of its operations from the British Virgin Islands to El Salvador might exempt it from the stablecoin bill’s jurisdiction.

Bitwise Senior Investment Strategist Juan Leon remarked that if stablecoin regulations are enacted in the U.S., it is likely to aid USDC in capturing market share. However, whether it will be sufficient to eclipse USDT remains questionable.

For USDC to surpass USDT, it would have to predominantly establish itself in developed markets, as Leon noted it may struggle to displace USDT’s stronghold in emerging markets.

Former SEC Chair Gary Gensler has previously labeled stablecoins as “poker chips” in decentralized finance (DeFi), being a common tool for traders to conveniently manage funds and secure profits. Though they serve practical purposes in remittances and payments, the use of stablecoins in illicit activities, like money laundering and evading sanctions, has generated significant controversy.

Aiming for Growth

Currently, the majority of on-chain stablecoin activities occur within networks that support smart contracts, such as Ethereum and Solana. Armstrong has indicated that expanding USDC’s presence on Base—the Ethereum scaling network developed by Coinbase—is crucial, in addition to fostering commercial collaborations.

"We believe USDC benefits from a network effect, and the compliant strategy Circle has adopted will provide long-term defensibility," Armstrong stated.

He further mentioned the intention to boost USDC’s market capitalization through more partnerships and by enhancing the payment functionalities across their product lineup.

In the fourth quarter, Coinbase reported stablecoin revenue of $224 million, a decline of $20 million from the previous quarter, accounting for 9.4% of the company’s total revenue.

In a shareholder letter, Coinbase described USDC as "the fastest-growing major stablecoin in 2024," highlighting the $12 billion in USDC payments facilitated on-chain by the exchange.

As Coinbase embarks on an aggressive strategy to expand USDC’s footprint, it’s noteworthy that during the bear market of 2023, when trading volumes were low, the company experienced stablecoin revenue supporting its subscriptions and services segment.

Indeed, in the third quarter of 2023, subscriptions and services revenue briefly exceeded transaction revenue, generating $334 million compared to $289 million.

In August of that same year, Circle announced that Coinbase had acquired an equity stake in the company, and both parties agreed to put aside a “self-governance consortium” to align their objectives more closely.

As of now, Circle and Tether have not issued comments in response to requests from Decrypt.

Edited by Stacy Elliott