Important Highlights

- The S&P 500 dipped slightly by less than 0.1% on Friday, February 14, following a report indicating a decline in retail sales during January.

- Airbnb’s shares surged after the company exceeded quarterly projections, showcasing its goal to expand into a complete living and travel solution.

- GoDaddy reported fourth-quarter earnings that fell short of expectations, resulting in a drop in its stock price.

U.S. major stock indices showed varied performance to conclude a trading week that shed light on inflation trends and shifting trade agreements.

Data released on Friday indicated a larger-than-anticipated decline in consumer spending for January, hinting at a consumer base hesitant to spend following a robust holiday season.

The S&P 500 ended the day marginally down by less than 0.1%, with the Dow decreasing by 0.4%. On a positive note, tech stocks showed resilience, allowing the Nasdaq to rise by 0.4%. Regardless of Friday’s mixed results, all three primary market indices achieved weekly increases.

Airbnb (ABNB) stood out as the best-performing stock on the S&P 500, rallying 14.5% after the vacation rental giant surpassed profit expectations for the fourth quarter, including bookings and gross bookings value. CEO Brian Chesky expressed plans for the Airbnb app to evolve into a comprehensive hub for travel facilitates.

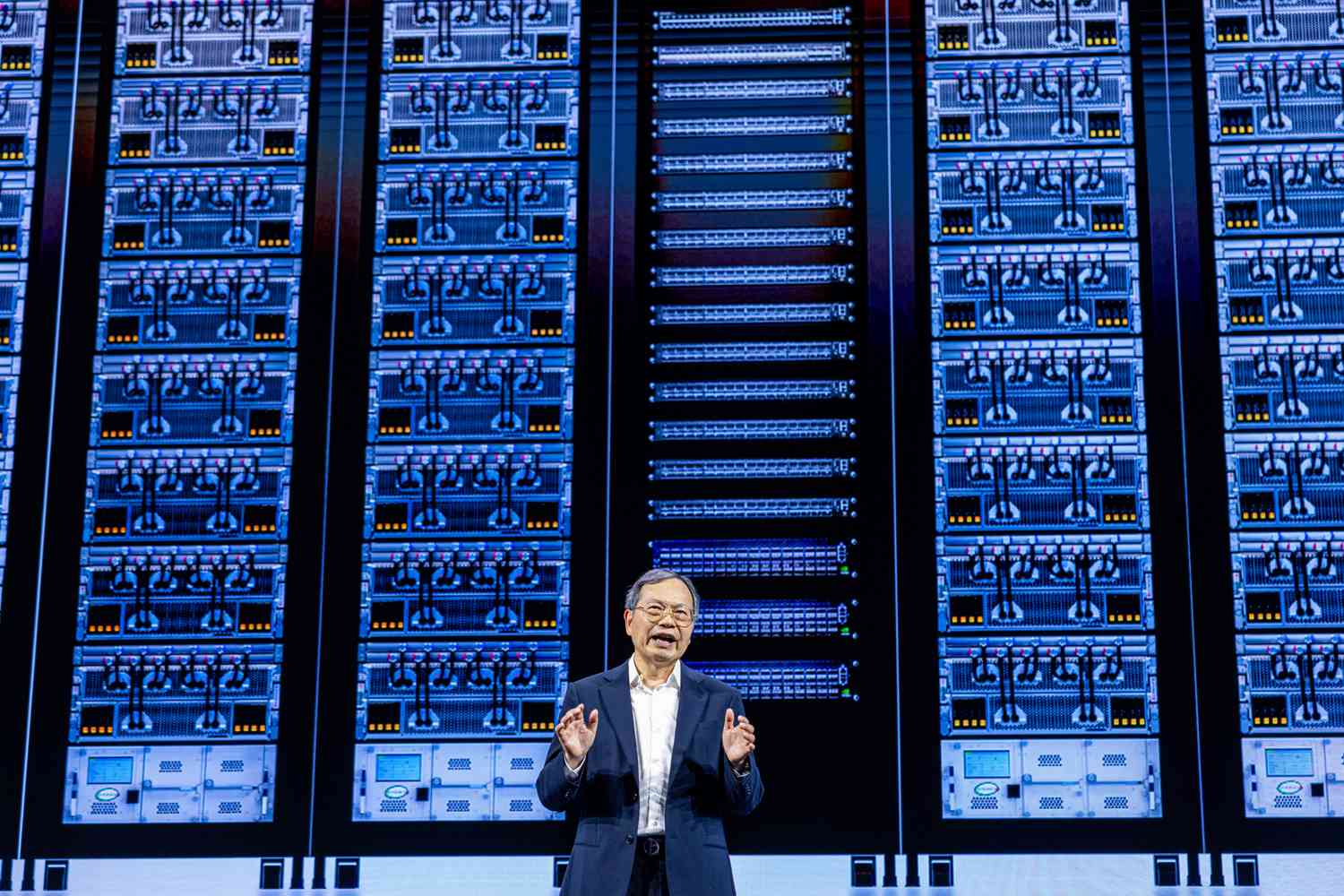

Super Micro Computer (SMCI) finished the week with an impressive gain of 13.3%. Along with a positive revenue forecast for fiscal 2026 provided earlier in the week, news that Meta Platforms (META) plans to invest heavily in humanoid robotics also contributed to the upswing. These robots are expected to utilize cloud-based AI technology, and Meta’s data centers run on Supermicro’s servers. Supermicro faces a deadline to submit its delayed annual report by February 25.

Wynn Resorts (WYNN) achieved exceptional results in the fourth quarter, exceeding both sales and profit projections, leading to a 10.4% jump in its stock price. Key highlights included strong performance from the Wynn Palace in Macau and its operations in Las Vegas, alongside progress reported on its integrated resort in the UAE, set to debut in March 2027.

GoDaddy (GDDY) experienced a significant plunge of 14.3%, marking the highest loss in the S&P 500, after the domain registrar released a mixed set of fourth-quarter results. Even though its revenue slightly exceeded predictions, earnings per share (EPS) did not meet forecasts. Analysts from Cantor Fitzgerald acknowledged GoDaddy’s advancements in product initiatives, including AI-driven marketing and design tools while also lowering their stock price target due to valuation concerns.

DaVita (DVA), a leader in dialysis and kidney care, saw its shares fall by 11.1%. The company provided a disappointing outlook for adjusted profits in 2025, largely due to rising healthcare costs. Additionally, prominent investor Berkshire Hathaway (BRK.A, BRK.B) reduced its stake in DaVita, further impacting the stock negatively.

Applied Materials (AMAT) saw a decrease of 8.2% after reporting its latest quarterly earnings. The semiconductor maker outperformed sales and profit estimates for the first fiscal quarter of 2025; however, it warned that recent export restrictions to China could adversely affect revenue, with projections estimating a $400 million decline throughout the fiscal year.