- Top Performers: Story [IP], Sonic [S], Maker [MKR].

- Notable Decliners: Raydium [RAY], Jupiter [JUP], Official Trump [TRUMP].

The cryptocurrency landscape continues to display significant price fluctuations, with certain tokens realizing impressive gains while others are undergoing sharp declines.

This week has seen explosive price movements among leading tokens, contrasted with substantial selling pressures on various assets. Below is an in-depth review of this week’s biggest winners and losers.

Top Gainers

Story [IP]

Story [IP] soared in the crypto sector this week, climbing 205% from $1.50 to $4.40.

The swift ascent for this token commenced on February 20, as a wave of buying activity escalated prices from $2.50 to an impressive peak of $5.80 by February 21.

This impressive rally was primarily driven by incredible trading volumes, especially during the session when IP reached its weekly high.

Nevertheless, profit-taking occurred above $5.50, leading to a retracement that has stabilized around $4.40.

Even with this pullback from its peak, IP holds strong support at $4.20, with consistent buyer engagement at this price level.

Current price trends indicate a bullish consolidation pattern, hinting at the potential for another upward move.

This week’s gains solidify IP’s position among the leading performers in the crypto arena, with key technical indicators firmly in bullish territory.

Sonic [S]

Sonic [S] captured considerable attention this week, rising 60% from $0.52 to $0.81. The former FTM token exhibited notable momentum, especially during its rally that peaked at $0.95 mid-week.

The bullish movement commenced on February 19, powered by strong buying activity that created a series of positive price candles, peaking on February 21.

Trading volumes surged significantly during this period, showcasing notable market interest in the token.

Although profit-taking emerged above the $0.90 mark, leading to a pullback, Sonic continues to exhibit a bullish stance. The token has found solid support around $0.80, with buyers actively defending this level.

Technical analytics suggest the prevailing uptrend is intact despite the current consolidation phase, with the $0.85 mark acting as key resistance—surpassing this could reignite buying activity.

Maker [MKR]

Maker [MKR] demonstrated remarkable strength this week, climbing 58% from $1,000 to $1,585.

The DeFi giant gained substantial momentum upon breaking through pivotal resistance levels, particularly the $1,200 barrier.

This bullish push accelerated on February 21, when MKR produced a significant bullish candle, propelling prices from $1,200 to $1,400 within a single trading session.

Trading volumes surged dramatically, while the MACD indicator confirmed strong bullish momentum by crossing above its signal line.

Technical analysis indicates that MKR’s price action has formed an impressive uptrend, with every retracement resulting in reliable support at escalating levels.

The token has successfully surpassed its 200-day moving average of $1,487, which has now shifted to a support level.

Recent sessions show MKR consolidating above $1,500, signaling that buyers are actively managing this price point. The MACD histogram continues to register higher highs, highlighting continued bullish momentum.

For traders looking for entry opportunities, the new support established at $1,500 is a crucial level to monitor.

Successfully maintaining this zone could position MKR for another upward surge, aiming for the $1,700 resistance level. However, breaking below $1,400 may indicate a short-term downturn.

Top 1,000 Gainers

In addition to the leading tokens, the wider market saw substantial gains.

Scotcoin [SCOT] topped the list of the top 1,000 tokens with a staggering 742% increase, while Undeads Games [UDS] and Solana Social Explorer [SSE] experienced gains of 295% and 266%, respectively.

Top Decliners

Raydium [RAY]

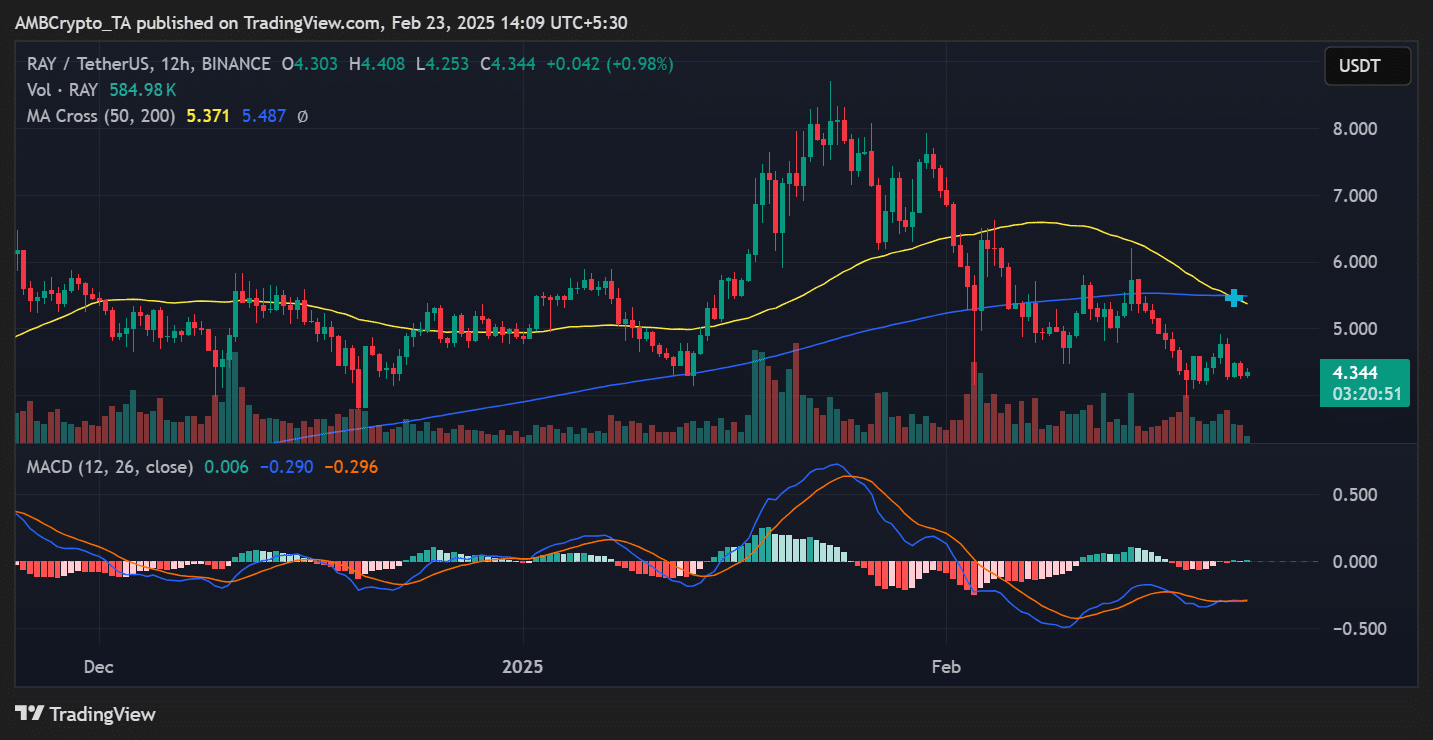

Raydium [RAY] positioned itself as the biggest decliner this week, falling 16% from $5.15 to $4.34.

This Solana-based DEX token encountered unyielding selling pressure, with the bears asserting their dominance in nearly every trading session since February 17.

The sharp downturn initiated with multiple significant red candles that breached essential support levels.

The most drastic decline unfolded in the initial days of the week when RAY plummeted from $5.15 to $4.20, briefly bouncing back at this support zone.

Despite a recovery attempt mid-week that nudged prices toward $4.80 on February 21, sellers swiftly regained control.

The MACD indicator currently remains negative, and a death cross pattern has appeared, indicating prolonged downward pressure.

For any substantial bounce back, RAY must reclaim $4.50 and break through the $4.80 resistance. However, the existing technical scenario suggests that bears continue to dominate.

Jupiter [JUP]

Jupiter [JUP] could not escape the broader market’s pressures, dropping 14% from $0.92 to $0.78. This Solana-centric DEX aggregator faced notable selling pressure, particularly in its early-week sessions.

The steepest decline was observed between February 17 and 19, when JUP fell from $0.92 to a local bottom of $0.70. While buyers attempted to leverage this support zone, the subsequent rebound proved short-lived.

As of now, JUP is consolidating between the $0.77 and $0.80 range, characterized by lower highs and lower lows.

The $0.75 level has emerged as critical support, with any breach likely to instigate another wave of selling activity.

Official Trump [TRUMP]

Official Trump [TRUMP] meme token has faced difficulties this week, losing 12% from $0.35 to $0.31. This politically themed token has been under persistent selling pressure, continuing its downtrend.

The decline accelerated mid-week, momentarily reaching $0.29 before staging a slight recovery. Despite attempts to stabilize around $0.32, the selling pressure remained overwhelmingly strong.

For any substantial recovery, TRUMP must reclaim and maintain levels above the $0.33 resistance, while the $0.30 support level serves as a significant challenge for the token.

Top 1,000 Decliners

Across the broader market, Unchain X [UNX] led the declines, dropping 62%, followed by Libra [LIBRA] and Griffain [GRIFFAIN], which recorded setbacks of 61% and 44%, respectively.

Final Thoughts

This concludes the weekly summary of the most significant gainers and losers. It’s essential to remember the volatile nature of the market, where prices can fluctuate dramatically.

Therefore, undertaking your own research (DYOR) prior to making any investment decisions is highly recommended.