- Top Performers: Mantra [OM], Kaspa [KAS], and Sonic [S].

- Notable Decliners: Bitget Token [BGB], Onyxcoin [XCN], and Ethena [ENA].

The cryptocurrency landscape continues to showcase significant volatility, with some tokens exhibiting exhilarating growth while others experience sharp drops.

This week has highlighted this dynamic landscape, as key winners leverage upward trends while struggling assets face substantial selling activity.

Below is a detailed analysis of the most prominent gainers and losers over the last week.

Top Gainers

Mantra [OM]

MANTRA [OM] has made an exceptional ascent, retaining the top position for the third week in a row with an impressive 26% increase, with prices rallying from $5.90 to $7.54.

The token’s sustained performance highlights its strong market presence and rising institutional interest.

The week commenced with OM stabilizing around $5.90, characterized by relatively stable price action until February 14.

However, February 15 witnessed a significant breakout, as prices surged past multiple resistance levels to hit $7.65.

Trading volume escalated to 549.34K OM, affirming the robustness of this upward momentum.

Technically, OM remains well above both its 50-day [$5.38] and 200-day [$4.01] moving averages, showcasing a strong bullish trend.

The significant gap between the current price and these averages indicates robust momentum, though caution is advised regarding possible overextension.

As of now, OM is stabilizing near $7.54, reflecting a slight -0.57% adjustment as traders process recent gains.

Achieving the top weekly gainer status for three consecutive weeks is a rare feat in the cryptocurrency market, showcasing persistent buyer confidence.

Key support is positioned at $7.00, which should provide a solid base for any short-term retracements.

Kaspa [KAS]

Kaspa [KAS] demonstrated an impressive rebound this week, climbing 25.6% from $0.087 to $0.109. This increase is particularly noteworthy in light of last week’s declines.

KAS initially found support at $0.087, which set the stage for a steady upward trajectory. A breakthrough on February 11 lifted prices to $0.105, creating a new support region.

Although midweek volatility brought fluctuations around $0.095, buyer control remained strong, ensuring bullish momentum.

At this time, KAS is consolidating at $0.109, with higher lows reinforcing renewed market optimism.

While some profit-taking is anticipated at this stage, consistent accumulation and robust buying pressure suggest that the upward trend may continue.

Sonic [S]

Sonic [S], previously known as FTM, achieved a 25.3% increase, rising from $0.41 to $0.51. This structured recovery follows recent market fluctuations.

The week started with sideways movement around $0.41, followed by a breakout on February 13 that propelled Sonic to $0.56 amid robust trading activity.

While some profit-taking occurred, buyers continued to assert their control over the trend.

Currently trading at approximately $0.51, with support forming at elevated levels, Sonic’s momentum suggests sustainability.

The measured pace of this advancement indicates genuine accumulation rather than speculative movements. If buying interest persists, there is significant potential for further gains.

Broader Market Gainers

In addition to the leading tokens, the wider market experienced notable increases.

Unchain X [UNX] topped the list with an extraordinary 387% gain, followed closely by TRUST AI [TRT] and STURDY [STRDY], which posted gains of 384% and 113%, respectively.

Top Decliners

Bitget Token [BGB]

Bitget Token [BGB] faced a significant decline of 24.3%, sliding from $6.45 to $5.05, as selling pressure dominated throughout the week.

The downturn intensified on February 12, breaking crucial support levels and leading to additional sell-offs. Every recovery attempt faced formidable resistance, forming a series of lower highs and lower lows.

Currently hovering around $5.05, any recovery would require reclaiming the $5.50 mark for stabilization. However, persistent selling pressure indicates potential for further declines.

Onyxcoin [XCN]

Onyxcoin [XCN] was the second-largest loser, dropping 14.6% from $0.026 to $0.023. The privacy-focused token struggled to maintain its momentum, facing consistent downward pressure.

A steep decline on February 11 and 12 pushed ONYX down to $0.020, followed by a brief recovery to $0.025. However, the lack of sustained buyer interest contributed to another downward slide.

Steady trading volume suggests a continued bearish trend as opposed to panic selling.

The $0.022 support level has become crucial; if breached, further selling may unfold. Conversely, ONYX must maintain a position above $0.025 for any recovery.

Ethena [ENA]

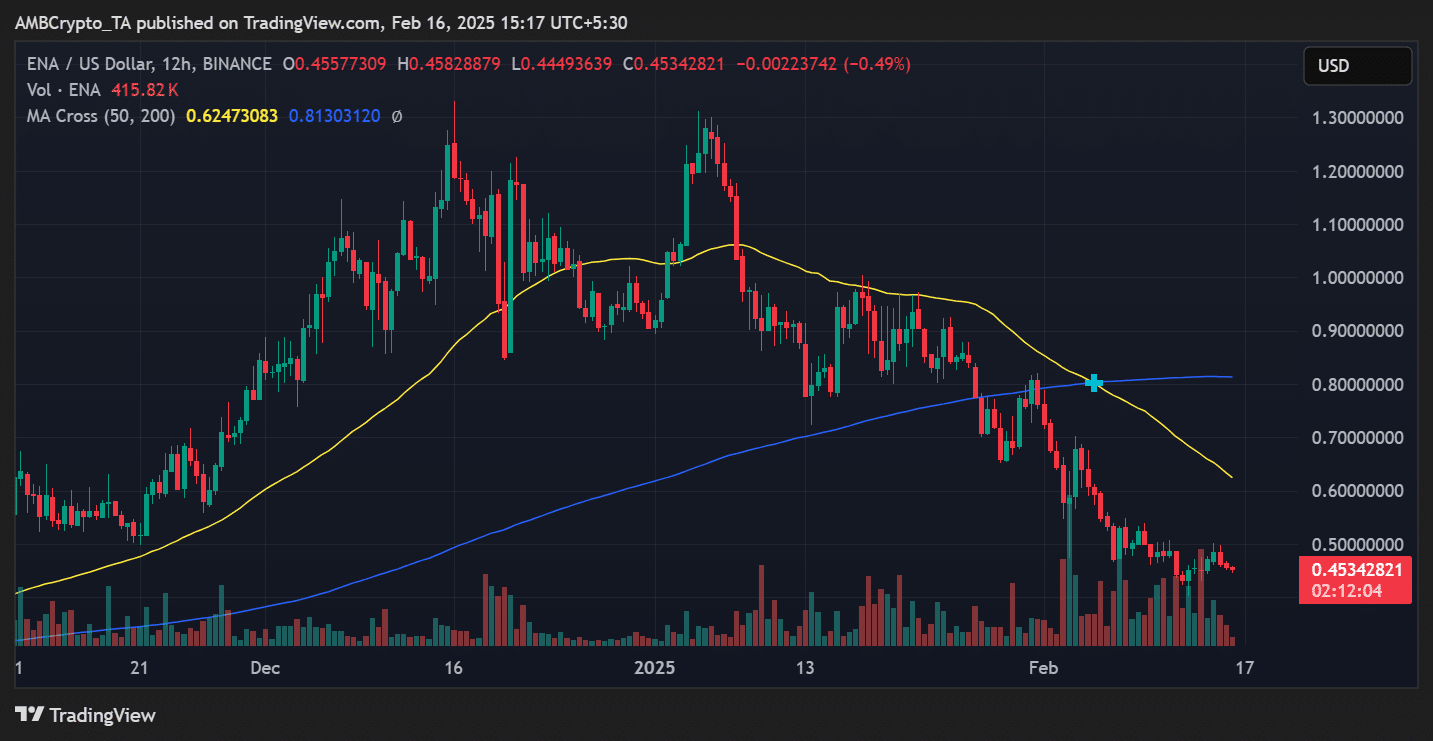

Ethena [ENA] marked itself as this week’s third-largest digital currency loser, exhibiting a substantial 11% drop from $0.50 to $0.45.

The native token of this protocol experienced intense selling pressure, particularly following unsuccessful attempts to stabilize above the essential $0.48 level.

Weekly price movements revealed a troubling technical arrangement, as ENA’s chart showed a pattern of lower highs and lower lows.

The most significant decline occurred on February 12, driving the token down to $0.42, marking the week’s lowest level. While buyers attempted a recovery, that bounce proved short-lived.

A deeper technical analysis indicated the 50-day moving average crossing below the 200-day MA, forming a bearish crossover—an indicator often suggesting continued downward momentum.

Notably elevated trading volume during the decline implies strong selling conviction.

Despite staging a brief recovery midweek, reaching $0.48 on February 14, ENA could not hold onto these gains.

Sellers swiftly regained control, pushing the price down to $0.45. The consistent rejections at higher levels indicate strong overhead resistance.

Traders should watch the $0.44 zone closely, as it serves as critical support. A breach could prompt further declines, potentially revisiting recent lows.

On the flip side, bulls must reclaim and sustain positions above $0.48 to signal any substantial trend recovery.

Broader Market Decliners

In the overall market, TEST [TST] led the decline, plunging by 78%, with 360noscope420balzeit [MLG] and Vine [VINE] following, experiencing drops of 53% and 50%, respectively.

Final Thoughts

Here’s a recap of this week’s top gainers and losers. It’s vital to recognize the inherent volatility in the market, where prices can fluctuate dramatically.

Conducting thorough research (DYOR) before making any investment choices is advisable.