The battle against inflation has reached its conclusion—I’m not referring to the conflicts in Ukraine or Gaza, but rather the ongoing struggle with rising prices.

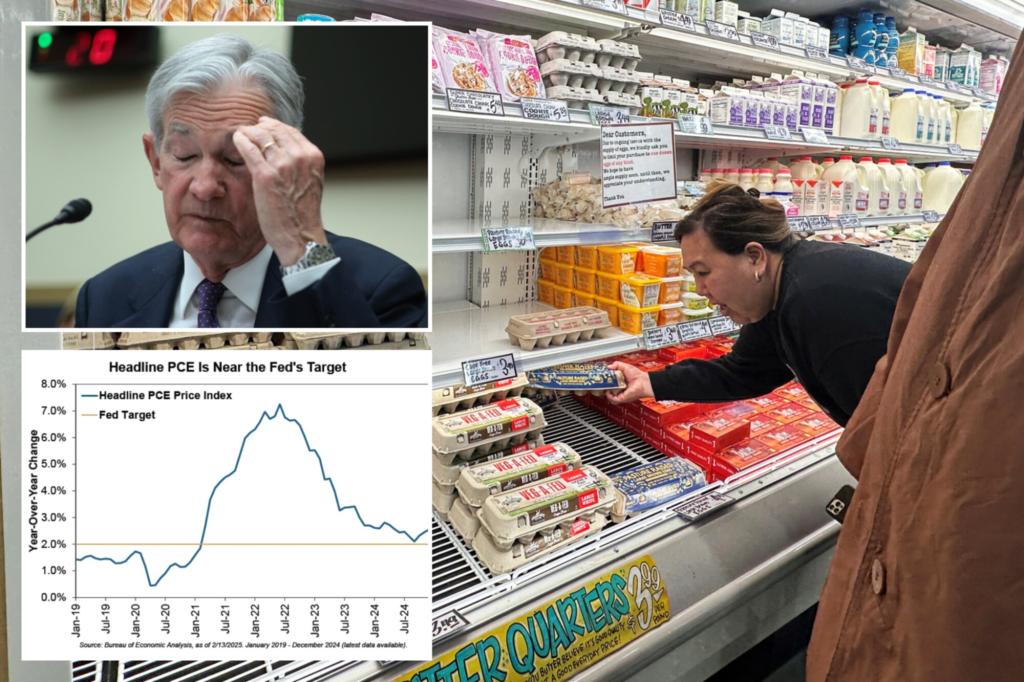

Consumers are understandably anxious while shopping, particularly with the recent surge in egg prices. Meanwhile, economists, politicians, and analysts are preoccupied with the so-called “sticky” price categories and increasing wages—especially in light of January’s Consumer Price Index (CPI) spike.

Yet, it seems everyone is fighting the last battle. What about your investment strategy?

Indeed, inflation has been a significant concern for households since 2021, causing considerable distress. The CPI for January was 23.4% higher than in December 2019, which doesn’t fully capture shoppers’ experiences, including your own. However, just because a military conflict ends doesn’t mean the aftermath disappears.

Unfortunately, a similar situation applies to inflation. It’s important to differentiate between prices and inflation. Inflation denotes the speed at which prices are increasing; currently, this rate is at 3% compared to last year, based on the CPI. While some select prices may decline, prices overall do not decrease. Broadly falling prices, known as deflation, are not common in developed nations. Why is that?

Experiencing real and profound deflation leads to economic depression, a far graver situation than inflation. Attempting to reverse the CPI’s post-pandemic surge could evoke conditions reminiscent of the 1929-1933 deflationary era or the post-World War I downturn of the early 1920s. Is that truly what you desire? I didn’t think so. Conquering the inflation issue has never been about slashing prices; it’s about moderating their rise.

Last November, I outlined why the Federal Reserve aims for 2% annual inflation. Following a peak of 9.1% in June 2022, the CPI has shown irregular cooling, landing at 3.0% in January. Despite concerns of escalation, this marks only a 0.1% increase from December—a mere statistical anomaly. Moreover, these metrics are inherently imprecise.

Interestingly, the “personal consumption expenditures price index,” which is the broader measure the Fed utilizes, was reported at 2.6% compared to the previous year in December. Analysts made a fuss over it being “stuck” above the 2% goal, exaggerating every minor fluctuation. However, there’s no solid proof that the Fed can finely tune these outcomes.

Interestingly, a significant component inflating the CPI is “shelter,” largely due to a dubious calculation called “owner’s equivalent rent”—a guess by government statisticians regarding what homeowners would theoretically pay to rent their own properties. In reality, no one pays this rental equivalent.

If we exclude shelter from the equation, December’s CPI was only 1.9% compared to last year, which even includes bird-flu-inflated egg prices. The Fed isn’t seeking it to be much lower, so don’t anticipate significant changes. The reality is that the “battle” against inflation has concluded.

Ultimately, inflation is a result of excessive money in relation to available goods and services. It has a time lag—when the growth rate of money supply consistently exceeds the GDP growth rate—and is predominantly driven by the Fed, which seldom accepts accountability.

During the tumultuous year of 2020, the Fed recklessly inflated the money supply. M4, the broadest measure, surged by 30.9% year over year by June 2020. M2 also experienced a significant spike at 26.6% in February 2021, leading to the subsequent rise in prices.

Now, with the Fed slowing its pace to growing the money supply by just 3.4% and 3.9%, respectively—both below the average growth rates observed since the 1980s—it’s crucial to adjust expectations. By subtracting about 2% from the annual GDP growth, inflation rates are anticipated to fall below 2%.

Concerned about rising wages? Last August, I explained why wage growth does not lead to inflation and why it never could. I won’t revisit that it was an extensive piece, but it’s worth looking up. Yet, it seems many economists, politicians, and analysts never grasp this concept.

Now, what about President Trump’s tariffs? Again, the crucial point is that tariffs do not influence the money supply. While tariffs can slightly elevate certain prices, their overall impact is often overestimated. They mainly redistribute demand, creating some beneficiaries and others at a disadvantage.

Indeed, tariffs represent an ineffective economic strategy, but inflation is not their root cause. Consider that we did not experience significant inflation during Trump’s first term despite the imposition of tariffs.

So, what is the overlooked yet significant reality for investors? Apologies for shattering some beliefs, but successful market forecasting requires recognizing opportunities others may miss. Merely echoing inflation concerns along with a plethora of “experts” won’t prove to be advantageous.

In conclusion, the inflation war is over. It’s time to adopt a positive outlook.

Ken Fisher is the founder and executive chairman of Fisher Investments, a four-time bestselling author of the New York Times, and a regular columnist in 21 countries worldwide.