In today’s travel landscape, where miles and points still hold significant value, the benefits of maintaining loyalty to a specific airline have diminished compared to years past. Generally, airlines are placing higher demands on loyalty program members to achieve status, while offering fewer rewards in return. This raises an important question: is it still worth it to stay loyal?

In this context, CNN recently published an insightful article discussing how frequent flyers have dedicated years to airline loyalty, only to feel undervalued (to borrow CNN’s phrasing, they’ve received “the middle finger”). This piece offers a refreshing perspective, and I think it’s valuable to share.

Flying Blue’s Ben Lipsey Understands Loyalty

Recently, British Airways significantly revamped its loyalty program, making it more arduous to earn elite status, with a greater emphasis on revenue generation. The CNN article features an interview with Ben Lipsey, Senior Vice President of Customer Loyalty at Air France-KLM and director of the Flying Blue loyalty program.

I’m personally appreciative of airline loyalty program leaders who have an authentic passion for miles and points; they tend to grasp the nuances of loyalty schemes better than those who approach it purely from a business perspective. Lipsey began his journey as an avid FlyerTalk participant in his youth and now helms one of Europe’s largest loyalty programs.

He shares several poignant insights that resonate with frustrated elite members of airline loyalty programs, reflecting a deep understanding of consumer behavior:

- “A rational consumer would choose the least expensive flight at the most convenient time. However, from a psychological standpoint, [loyalty programs] aim to provoke irrational choices.”

- “It’s crucial for customers to perceive opportunities for gamification within the program.”

- “When you connect flights like London-Paris-New York or London-Amsterdam-Tokyo, you can attain status more efficiently. Personally, I find that agreeable.”

- “Many companies overlook the fact that loyalty is reciprocal; it’s not just a transactional exchange. Trust plays a vital role… Changes made to the program influence the airline and vice versa.”

- “British Airways essentially proclaimed ‘Gold is valued at £20,000,’ prompting customers to ask themselves if they’re receiving that level of value. If it’s strictly revenue-based, that presents a risk, as it tends to eliminate the irrational behavior that is central to loyalty programs.”

- “They’ve made a bold decision. Essentially, they have decided to let go of leisure travelers. Whether this is a prudent choice is up to them to determine. I trust they conducted thorough research.”

Interestingly, Lipsey noted that Flying Blue has been offering status matches to customers from other airlines, particularly targeting British Airways loyalists. He anticipates that these matches could yield an additional €20-30 million in customer value, which is worth considering.

Flying Blue Explores Revenue Component for Elite Status

One intriguing point Lipsey raises in this discussion hints at potential future modifications to the Flying Blue program. He mentioned that discussions are underway about possibly introducing a “revenue component” to elite status requirements—like establishing minimum spending or flight criteria—but nothing has been finalized. He aptly concludes, “Loyalty can’t be assigned a monetary value.”

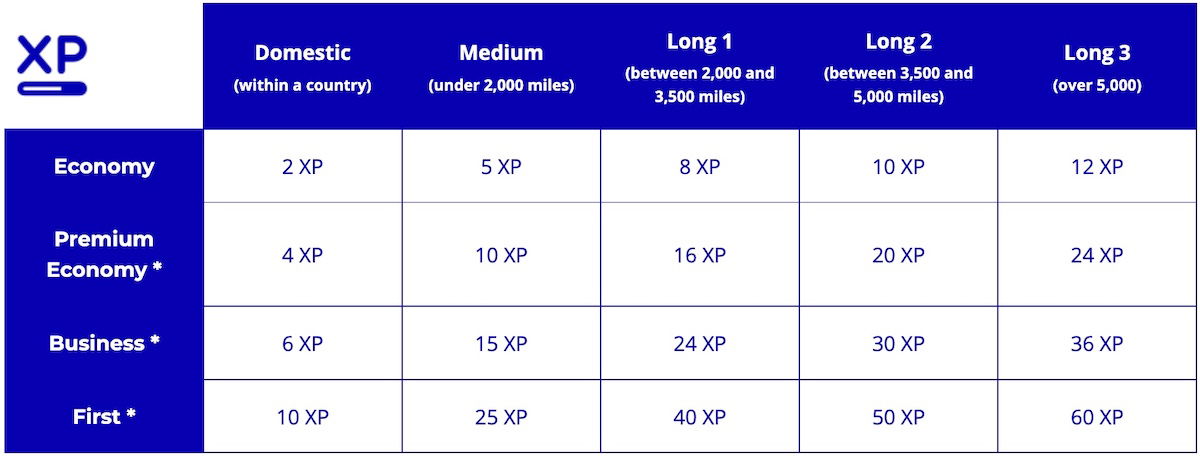

At present, Flying Blue elite status is relatively simple to attain, determined by the accumulation of “experience points” (XPs), which account for the number of segments flown, fare class, and trip distance. The program allows for flexibility in terms of airlines flown, be it Air France-KLM or a partner, without emphasizing spending.

As we contemplate potential changes, I wonder how Flying Blue might adapt its requirements. The program could impose a specific threshold of XPs earned solely on Air France-KLM flights (currently labeled as UXPs, which are relevant only for Ultimate status) or mandate a certain number of flight segments.

However, I’m uncertain how to implement meaningful changes without veering into “assigning a price to loyalty.”

My inclination is that significant changes aren’t imminent, as Flying Blue will likely observe the outcomes of British Airways’ recent alterations. After all, British Airways has already started to respond to the backlash against its program modifications.

I suspect loyalty program executives often fall into the misconception that stricter requirements for status will encourage consumers to spend more with their airline. However, this perspective overlooks the additional business generated by patrons who may not spend excessively but choose to prioritize flying with the airline. Recently, I wrote about the types of travelers that loyalty programs should reward most generously.

Conclusion

Ben Lipsey’s comments provide a refreshing perspective amidst the current trends in the airline industry and in response to British Airways’ recent changes.

I believe Lipsey’s viewpoint is spot on—creating loyalty programs that incorporate elements of gamification can encourage consumers to engage in less rational behavior. Once a loyalty scheme becomes entirely revenue-driven, it diminishes the appeal of loyalty itself, rendering it more a matter of arithmetic than genuine connection.

What are your thoughts on the ongoing loyalty program discussions?