- Bitcoin has recently experienced a significant phase of price stabilization following a prolonged period of consolidation.

- In recent weeks, its volatility has decreased alongside price movements in the market.

Bitcoin (BTC) has gone through a notable period of price stabilization, often characterized as sideways movement—an occurrence historically associated with increased retail investor interest. After a drawn-out consolidation phase, Bitcoin appears poised for a positive shift, fueled by a resurgence in retail demand that could push its price upward.

Market Optimism and Potential Growth

In the past month, retail investor engagement with Bitcoin has decreased by approximately 2%, a significant reduction compared to the 20% drop observed in January.

This decline in retail interest suggests a moment of market balance, creating an environment ripe for potential upward movement. Current analysis indicates that recent fluctuations in retail demand are correlated with previous price increases.

The smaller drop in retail engagement noted over the last month signals that the consolidation phase may be nearing its conclusion. As retail demand begins to recover, it could result in a favorable shift in market sentiment, which may positively influence Bitcoin’s price in the short term.

Bitcoin’s Strong Basis for Future Advancement

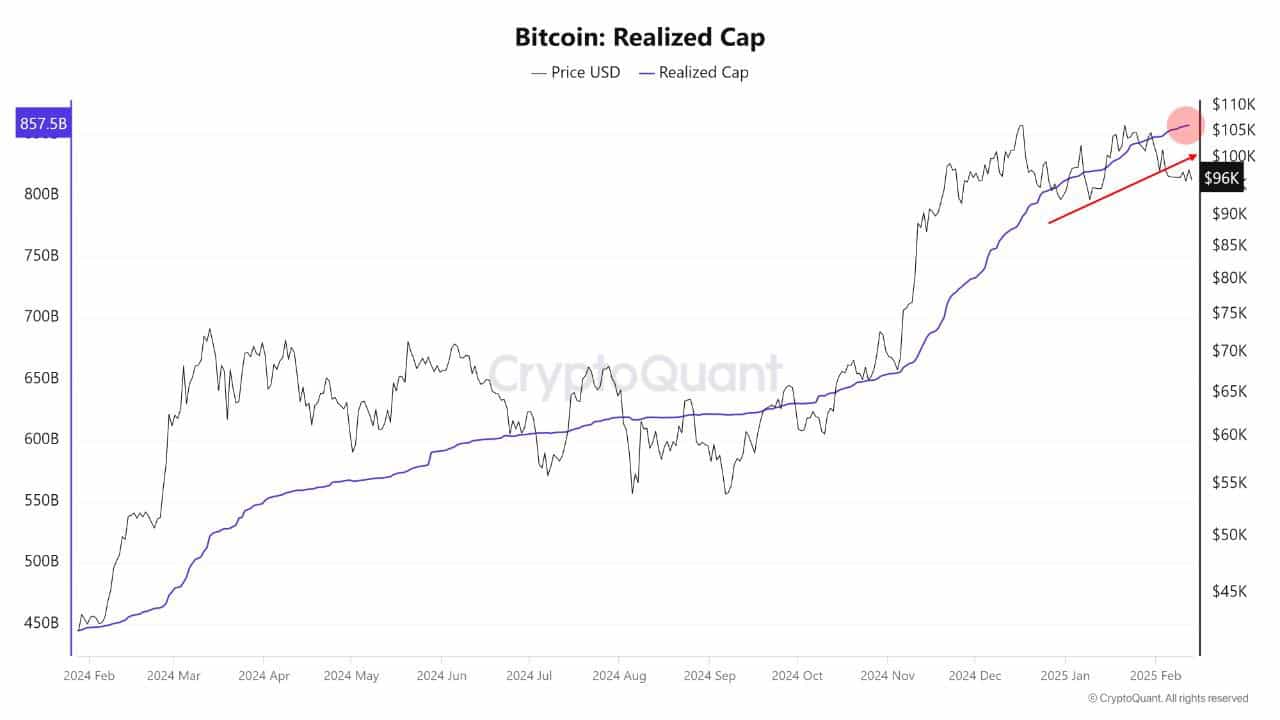

Bitcoin’s realized market capitalization recently reached a historic high of $857 billion, underscoring the ongoing vitality of its bullish trend. This demonstrates the market’s resilience despite periodic price corrections.

Many long-term investors are taking advantage of rising prices, suggesting strong confidence in the asset’s enduring value. At the same time, new investors are entering the market, absorbing selling pressure while also contributing to upward momentum.

This dynamic interaction between seasoned holders and newcomers reinforces a bullish outlook for Bitcoin, supporting the potential for continued price appreciation in the near future.

Effects of Profitable Positions on Price Trajectory

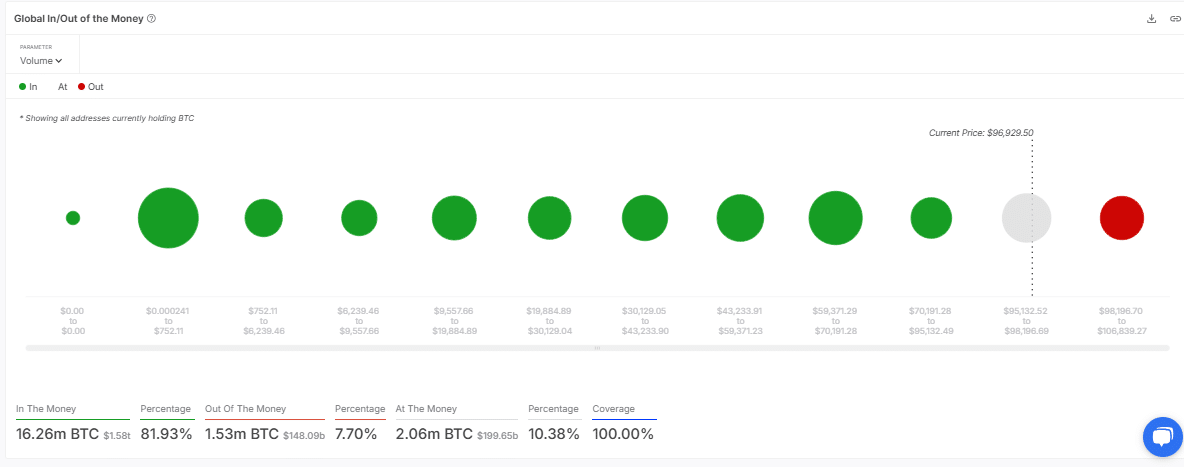

Recent evaluations of Bitcoin’s Global In/Out of the Money metric indicate that its approximate price of $96,929.50 places a significant number of addresses ‘In the Money.’ This finding indicates that a considerable portion of investors are currently in profitable positions.

This situation tends to generate a fear of missing out (FOMO) among potential buyers eager to enter the market before prices rise further.

With fewer addresses in the ‘Out of the Money’ category, selling pressure is reduced, potentially leading to a more stable and consistent increase in price. The current landscape suggests that a favorable ratio of profitable positions could further enhance Bitcoin’s momentum.

A Sign of Potential Upside?

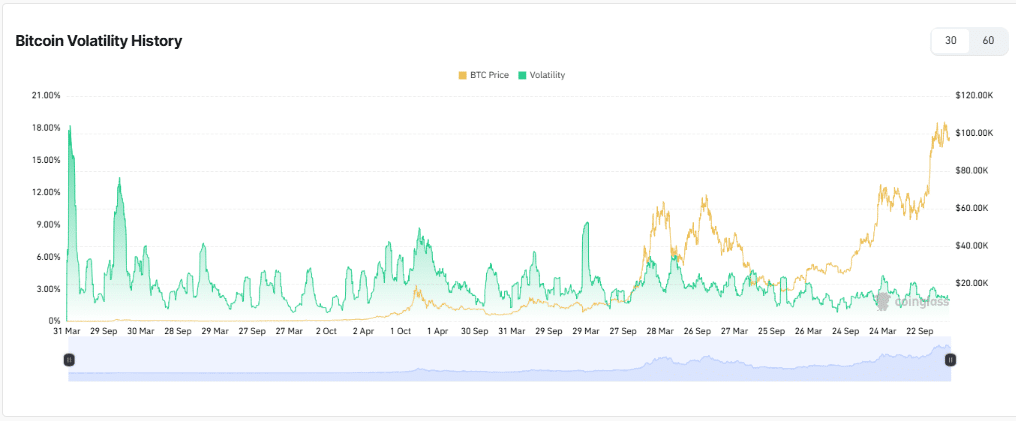

Lastly, Bitcoin has seen decreased volatility in recent weeks alongside its price actions. Since lower volatility periods often precede substantial price movements, it suggests the market could be preparing for a significant breakout.

This combination of reduced volatility, a high market cap, and positive retail activity is crucial for BTC’s price dynamics. A decline in volatility, along with other optimistic indicators, could herald a bullish trend, suggesting that Bitcoin might break free from its current consolidation phase.