Recent insights from leading economists indicate that the Federal Reserve’s new approach to employment—sparked by the Black Lives Matter movement—may have contributed to rising inflation rates. This policy shift has come under scrutiny as many believe it prevented the Fed from effectively combating inflation.

Traditionally, the Fed has been cautious about both high and low unemployment rates. Historically, they would increase interest rates when joblessness was exceptionally low to mitigate inflation risks.

However, in 2020, following the tragic death of George Floyd, the Federal Reserve repositioned its focus to a “broad-based and inclusive” employment objective. This pivotal change effectively ceased the previous restrictions associated with low unemployment levels.

“It was no longer sufficient to meet employment goals overall; it was critical to meet them inclusively across different demographic groups,” noted Kenin Spivak, CEO and Chairman of SMI Group, in a statement to The Post. He further asserted that the Fed missed crucial opportunities to raise interest rates, which led to persistent inflation experienced during the Biden administration—a situation from which the economy is still gradually recovering.

Economists have raised concerns that this “inclusive” employment strategy may be a key factor behind the inflation rates that soared to a forty-year high during Biden’s presidency. As the central bank approaches its first strategic review since 2020, this topic remains at the forefront of economic discussions, as highlighted by Bloomberg’s report.

Since 2012, the Federal Reserve’s rate-setting committee has approved an annual strategic document outlining its long-term objectives. The initial review of this document took place in August 2020, coinciding with a spike in unemployment above 10% and inflation rates considerably below the Fed’s 2% target, amid nationwide protests following George Floyd’s death.

During this time, the Fed articulated its commitment to a “broad-based and inclusive” employment policy, stating they would only take action to address employment shortfalls, or high unemployment rates.

The Fed’s “aggressive interpretation” of maximum employment hindered rate hikes in 2021, as inflation began to rise, according to research by UC Berkeley economists Christina Romer, former chair of Barack Obama’s Council of Economic Advisers, and her husband, David Romer. They concluded that this reinterpretation significantly slowed the Fed’s reaction to escalating inflation.

Moreover, a paper released last year by Michael Kiley, deputy director of the Fed’s financial stability division, argued that this policy adjustment may have had adverse effects.

Kiley noted that focusing exclusively on employment shortfalls tended to amplify economic fluctuations, further complicating issues surrounding employment and contributing to inflationary pressures, as compared to the Fed’s previous approach.

The inflation rate peaked at 9.1% in 2022—the highest since 1981. In 2023, while inflation moderated to 4.1%, the unemployment rate reached its lowest point in over fifty years.

Despite these fluctuations, inflation has remained above the Fed’s 2% target, registering at 3% in January, Biden’s final month in office, as reported by the Bureau of Labor Statistics Consumer Price Index.

“By overly emphasizing the goal of maximum employment at the expense of controlling inflation, the Fed is harming Americans. Many workers’ after-tax wages are not keeping pace with inflation,” stated Ted Jenkin, co-founder of oXYGen Financial. “Ultimately, even if individuals are employed, if their income cannot keep up with living costs, they face significant challenges. Therefore, it is essential for the Fed to rebalance its focus towards controlling inflation.”

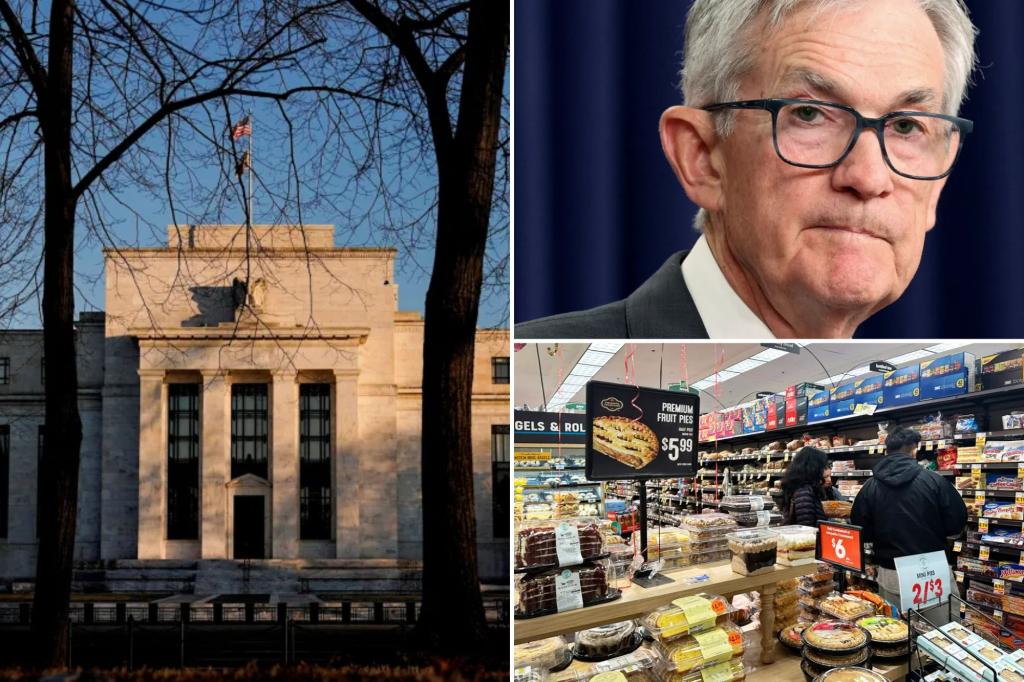

Federal Reserve Chair Jerome Powell has staunchly defended this strategy shift, famously labeling the soaring inflation rates as “transitory.” At a recent meeting, he reiterated his stance that it would be illogical to increase rates without clear evidence of inflation.

“Why would anyone want to proactively dismiss workers in the absence of evidence indicating unsustainable job growth?” Powell questioned.

Joseph Camberato, CEO of National Business Capital, echoed support for the Fed’s commitment to maximizing employment. He acknowledged the current economic climate is complex, with various factors influencing price increases, but emphasized the Fed’s careful navigation has helped avert a recession and prevent runaway inflation.

Ken Mahoney, CEO of Mahoney Asset Management, commented on today’s economic balance: “Having a significant majority of the workforce employed while facing higher inflation appears more favorable than scenarios involving greater unemployment and lower inflation levels.” However, he also recognized that inflation has been a significant challenge since 2020.