- Ethereum ETFs saw a significant rise in institutional ownership, climbing from 4.5% to 14.5% in the fourth quarter of 2024.

- Grayscale has requested approval from the SEC for a staking feature within its ETH ETF.

During the fourth quarter of 2024, the institutional uptake of Ethereum ETFs increased notably, contrasting with a bearish outlook among retail investors. According to Juan Leon, a senior investment strategist at Bitwise, institutional participation in ETH ETFs surged by around 10%, jumping from 4.8% to 14.5%.

Leon emphasized the significance of this shift, stating:

“Institutional ownership of ETH ETFs rose from 4.8% in Q3 to 14.5% in Q4. Major institutions are clearly embracing ETH.”

Escalating Adoption Trends

Interestingly, there has been a relatively higher adoption rate of ETH ETFs compared to Bitcoin ETFs during this timeframe, even as Bitcoin remains dominant across various market sectors.

Leon indicated that institutional adoption for Bitcoin ETFs was 21.5% in Q4 2024, a slight decline from 22.3% in Q3.

Source: X

This analysis is based on the latest 13F filings submitted to the SEC, which provide insights into the moves of leading managers with over $100 million in assets under management (AUM).

Fintel data highlighted that BlackRock’s ETH Trust, ETHA, is primarily held by firms like Goldman Sachs, Millennium Management, and Brevan Howard Capital, who possess shares valued at $235M, $105M, and $94M, respectively.

Leon also noted that increased institutional ownership signifies a new phase of adoption.

“This indicates we are entering the next stage of institutional accumulation, with significant players such as sovereign wealth funds and pension funds getting involved.”

Additionally, a promising development is the push for ETF staking. Recently, the SEC Crypto Task Force held discussions with Jito Labs and crypto venture capital firm MultiCoin Capital regarding this initiative, generating optimism for the potential inclusion of staking features in ETFs. Grayscale has submitted an application to the SEC for a staking feature for its U.S. Spot ETF product.

Nate Geraci from the ETF Store commented on these advancements, suggesting that ETF staking is “just a matter of time.”

“Rather than simply rejecting proposals, the SEC is now engaging in constructive dialogues. This is promising. In my opinion, staking for ETH ETFs is inevitable.”

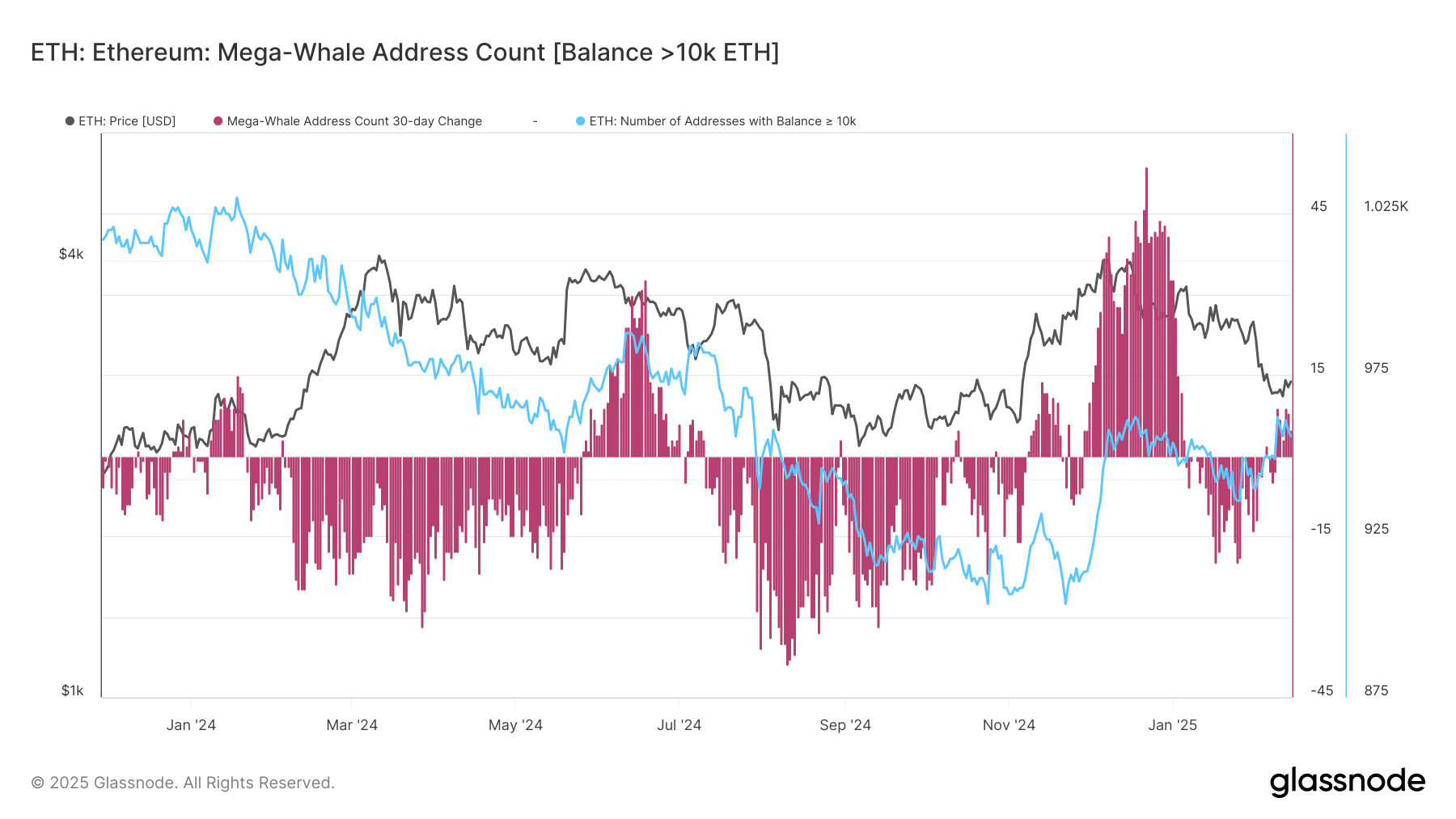

Moreover, February saw a resurgence in the count of mega-whale addresses (those holding over 10,000 ETH), which increased from 936 to 956 addresses.

However, despite this surge in institutional interest, ETH’s market price has remained subdued, trading at $2,700, which represents a 34% decrease from its high of $4,100 in December.