In certain regions of the United States, individuals are facing healthcare expenses that are up to ten times greater simply based on their geographical location.

Experts attribute these stark differences in healthcare costs to a variety of factors, including a shortage of healthcare professionals in rural settings, high uninsured rates in Southern states, and a significant dependence on private insurance in areas like the Northeast and Upper Midwest.

A comprehensive analysis revealed that while health insurance absorbs most healthcare costs, Americans collectively incurred nearly half a trillion dollars in out-of-pocket expenses in 2019 — marking an all-time high.

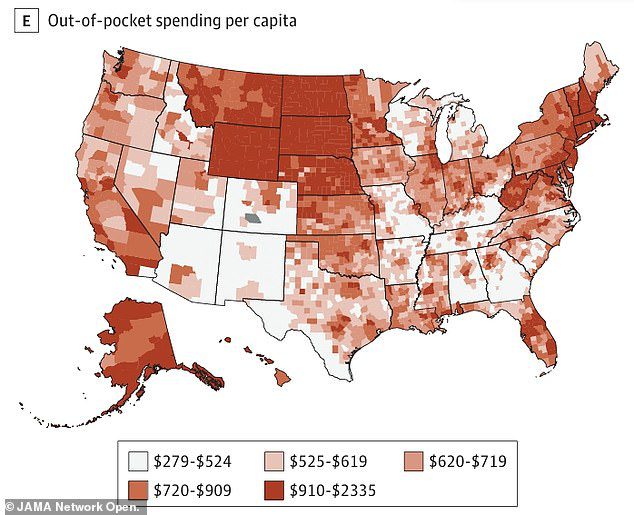

Counties in Alaska, Wyoming, Montana, and the Dakota regions, along with certain areas in New England, reported the highest out-of-pocket expenditures in 2019, ranging from $720 to $2,335 per individual.

Research conducted by the University of Washington highlights that states like these, as well as those in New England, heavily rely on private health insurance to manage medical expenses. However, even when individuals seek care covered by their insurance, they frequently confront additional costs, such as deductibles, copayments, and coinsurance.

Conversely, many counties in Southern states, where residents are often underinsured, displayed lower out-of-pocket expenses. This suggests that without adequate health coverage, many people may avoid seeking necessary medical care.

In coastal regions, higher out-of-pocket spending tended to align with urban centers, including Boston, Washington, DC, Miami, Los Angeles, and Seattle, where healthcare-related costs are notably elevated.

In 2019, rural states like Alaska, Wyoming, Montana, and the Dakotas had the highest out-of-pocket spending, ranging from $720 to $2,335 per person. In contrast, counties in Southern states with higher underinsurance rates had lower spending, indicating that lack of coverage may lead people to avoid care.

The research team from the University of Washington analyzed over 40 billion insurance claims, nearly a billion facility records, and various survey datasets to illustrate how healthcare spending varies across 148 health conditions in 3,110 counties.

For individuals under the age of 65, approximately 12 percent of healthcare expenditures were made out-of-pocket, totaling around $288 billion.

More than half of healthcare services were funded by private insurance, around 25 percent by Medicaid, and 7 percent from Medicare.

Once individuals reach 65 and are automatically enrolled in Medicare—a federally funded program for seniors—11.5 percent of services are covered out-of-pocket, translating to about $276 billion.

Over 60 percent of services were covered by Medicare, while more than 18 percent were paid by private insurance and 7 percent by Medicaid.

Notably, the most pronounced discrepancies in healthcare spending by county arose from the out-of-pocket expenses incurred, adjusted for age.

Over time, the out-of-pocket costs for Americans have been steadily increasing.

Although the latest research did not specify per-person out-of-pocket spending for 2019, the Kaiser Family Foundation estimated it at $1,375 per person, rising from $900 per person three decades ago.

Alongside patient out-of-pocket costs, researchers also examined spending by private insurers, Medicare, and Medicaid for healthcare services ranging from check-ups to hospital admissions.

This recent study encompassed more than 76 percent of personal healthcare expenditures from 2010 to 2019.

The main driver of differences in healthcare spending by county was the utilization rate, or how much people use healthcare services. More doctor visits, preventive screenings, and diagnostic tests mean more spending by insurers or patients.

Differences in healthcare spending across counties were primarily driven by the utilization rate, or how frequently individuals access healthcare services.

Increased doctor visits, preventive measures, and diagnostic evaluations result in higher expenditures by both insurers and patients.

Without insurance, the prices of essential medical services can become overwhelming, leading to nearly half of uninsured individuals delaying necessary medical care because of financial barriers.

According to Dr. Joseph Dieleman, the study’s lead author, “Improved insurance coverage would likely encourage more individuals to seek regular health checkups, potentially decreasing the need for emergency services.

“Such a transition would improve overall health outcomes, allowing emergency departments to concentrate on those with urgent medical needs.”

The Southeast and Southwest regions tend to be home to a higher percentage of uninsured populations, with those in the Southeast often relying on their state’s Medicaid programs.

Following the enactment of the Affordable Care Act (commonly known as Obamacare), states were given the option to broaden their Medicaid programs, enabling coverage for a wider income bracket and additional federal funding to support this expansion.

Unfortunately, ten states, including Wyoming, Texas, Kansas, Mississippi, Alabama, Georgia, South Carolina, Tennessee, Florida, and Wisconsin, have not yet expanded Medicaid.

In fact, Southern states encompass approximately 92 percent of the 2.5 million individuals trapped in the Medicaid coverage gap.

The counties with the highest age-standardized spending per capita in 2019 were Nassau County, New York ($13,332), Suffolk County, New York ($12,689), and the District of Columbia ($12,534). On the other hand, the counties with the lowest age-standardized spending per capita were Clark County, Idaho ($3,410), Loving County, Texas ($3,923), and Kennedy County, Texas ($4,027).

For those individuals, expanding Medicaid in their state would make them eligible for the program. However, their income often falls short of qualifying for health insurance subsidies, which leaves them bearing the costs of their medical care.

With inadequate insurance coverage, individuals are generally less inclined to visit their doctors, resulting in relatively low per-person out-of-pocket spending.

In the Upper Midwest and Northeast, on the other hand, the majority of residents depend on private insurance to manage their healthcare expenses.

According to the findings from the University of Washington, these regions exhibited some of the highest levels of per capita healthcare spending.

Out-of-pocket costs in these areas were also substantial, likely due to elevated deductibles, copayments, and coinsurance rates.

Access to healthcare services is generally more robust in metropolitan or suburban regions, leading to increased spending in these locales.

In contrast, remote areas in Alaska and the Midwest may face healthcare provider shortages and limited insurance options, culminating in high out-of-pocket costs.

The primary area of expenditure among insurers, government programs, and individuals was on diabetes care, totaling $143.9 billion.

Medicaid spent the least amount of money on healthcare services in Southeastern states that have not passed laws to expand access to benefits to a wider population of low-income residents.

Following diabetes, significant expenditures were observed for musculoskeletal disorders like joint pain and osteoporosis ($108.6 billion), oral health issues ($93 billion), and ischemic heart disease ($80.7 billion).

Overall, 42 percent of the total spending was allocated to outpatient care, 24 percent towards hospital inpatient services, and 14 percent for prescription medications.

Healthcare expenditure per county varied greatly, from $3,410 per person in Clark County, Idaho, to $13,332 per person in Nassau County, New York.

The conclusions of this study were published in the Journal of the American Medical Association.

The most significant variations in healthcare spending across counties were associated with out-of-pocket expenses and private insurance contributions. Key factors influencing these discrepancies included the frequency of healthcare utilization, although cost and intensity of care also played a role, particularly among those covered by Medicare.