BP Shifts Focus from Renewables to Oil and Gas Production

By Simon Jack and Faarea Masud, BBC News Business Editor and Reporter

Image Source: Getty Images

BP has made a significant decision to reduce its investments in renewable energy, opting instead to prioritize the expansion of oil and gas production. This strategy was disclosed on Wednesday, driven by pressures from investors who expressed dissatisfaction with the company’s lower profits and share performance when compared to its competitors.

The energy titan announced plans to increase its yearly investments in oil and gas by approximately 20%, bringing the total to around $10 billion (£7.9 billion). Simultaneously, BP will cut its previously projected funding for renewable initiatives by over $5 billion (£3.9 billion).

This pivot aligns with movements from rival firms like Shell and the Norwegian company Equinor, both of which have also moderated their commitments to green energy. Additionally, remarks from U.S. President Donald Trump promoting fossil fuel development have further incentivized investments in traditional energy sources.

BP’s CEO, Murray Auchincloss, indicated that the company would adopt a more selective investment approach to businesses focused on the energy transition. He stated that future funding for renewable projects will be between $1.5 billion and $2 billion annually, reflecting a "reset" strategy aimed at enhancing shareholder returns.

Chairman Helge Lund added that at the core of this new direction lies a focus on increasing cash flow. Although BP’s stock experienced a brief surge before the announcement on Tuesday, it declined soon after.

BP’s decision mirrors a trend among various companies in the energy sector returning to oil and gas production, which has seen profit increases due to rising prices following the declines during the COVID-19 pandemic. BP aims to scale up production to between 2.3 million and 2.5 million barrels of oil per day by 2030, with expectations of launching significant oil and gas projects by the end of 2027.

Auchincloss is under considerable pressure to elevate profits from stakeholders, including the influential activist group Elliot Management, which has acquired a significant stake in BP for around £4 billion, advocating for increased investments in fossil fuels.

In 2024, BP’s net income dropped to $8.9 billion (£7.2 billion), a decrease from $13.8 billion the year prior. However, this strategic shift has raised concerns among other investors and environmental advocates. Recently, 48 investors called for a vote on BP’s potential reconsiderations of its renewable commitments. Environmental group Greenpeace UK criticized the latest developments, asserting that fossil fuel companies are falling short in the fight against the climate crisis.

"The Transition is Collective"

In response to inquiries regarding the reduced commitment to renewable energy, Louise Kingham, BP’s Senior Vice President for Europe and the UK, assured that the recent changes will not hinder the UK’s green energy initiatives, which encompass multiple wind farms and carbon capture projects. Kingham maintained that despite a slowdown in the transition to renewable sources, BP’s determination to become a net-zero company remains steadfast.

The International Energy Agency has indicated that no new fossil fuel projects can align with the goal of limiting global warming to 1.5°C above pre-industrial levels. Kingham emphasized the need for a more strategic and efficient transition while balancing returns for BP’s shareholders, stating, “It’s not just the decision of one company and what it chooses to do; it requires a collective effort.”

The scaling back of renewable investments will impact projects related to biogas, biofuels, and electric vehicle infrastructure. Meanwhile, BP plans to explore "capital-light partnerships" in sustainable energy sectors, such as wind and solar. The company has already formed a joint venture for its offshore wind operations with Japan’s Jera and is seeking partners for its solar initiatives.

A Shift in Ambitions

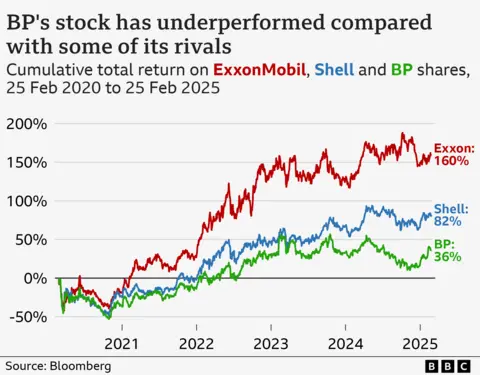

Five years ago, BP set ambitious goals to reduce oil and gas production by 40% by 2030 and to considerably increase its investments in renewable energy. However, by 2023, the company adjusted its reduction target to 25%. Since former CEO Bernard Looney introduced this vision, shareholders have generated total returns, including dividends, of 36%. In comparison, shareholders with rival companies Shell and Exxon have seen returns of 82% and 160%, respectively.

BP’s underperformance has led to speculation that it might become a target for acquisition or consider relocating its primary stock market listing to the United States, where oil and gas companies typically enjoy higher valuations.

Continuous Pressure on Energy Transition

Sir Ian Cheshire, a seasoned executive with a background at companies like B&Q and Barclays, expressed wonder about the long-term viability of BP’s recent strategy. During a discussion on BBC’s Today program, he noted that the overall shift toward renewable energy would inevitably continue, reinforcing that climate change remains an unresolved issue and that the science supporting this remains unchanged.