Essential Insights

- Nvidia is anticipated to release its fourth-quarter earnings report following the market’s closure on Wednesday.

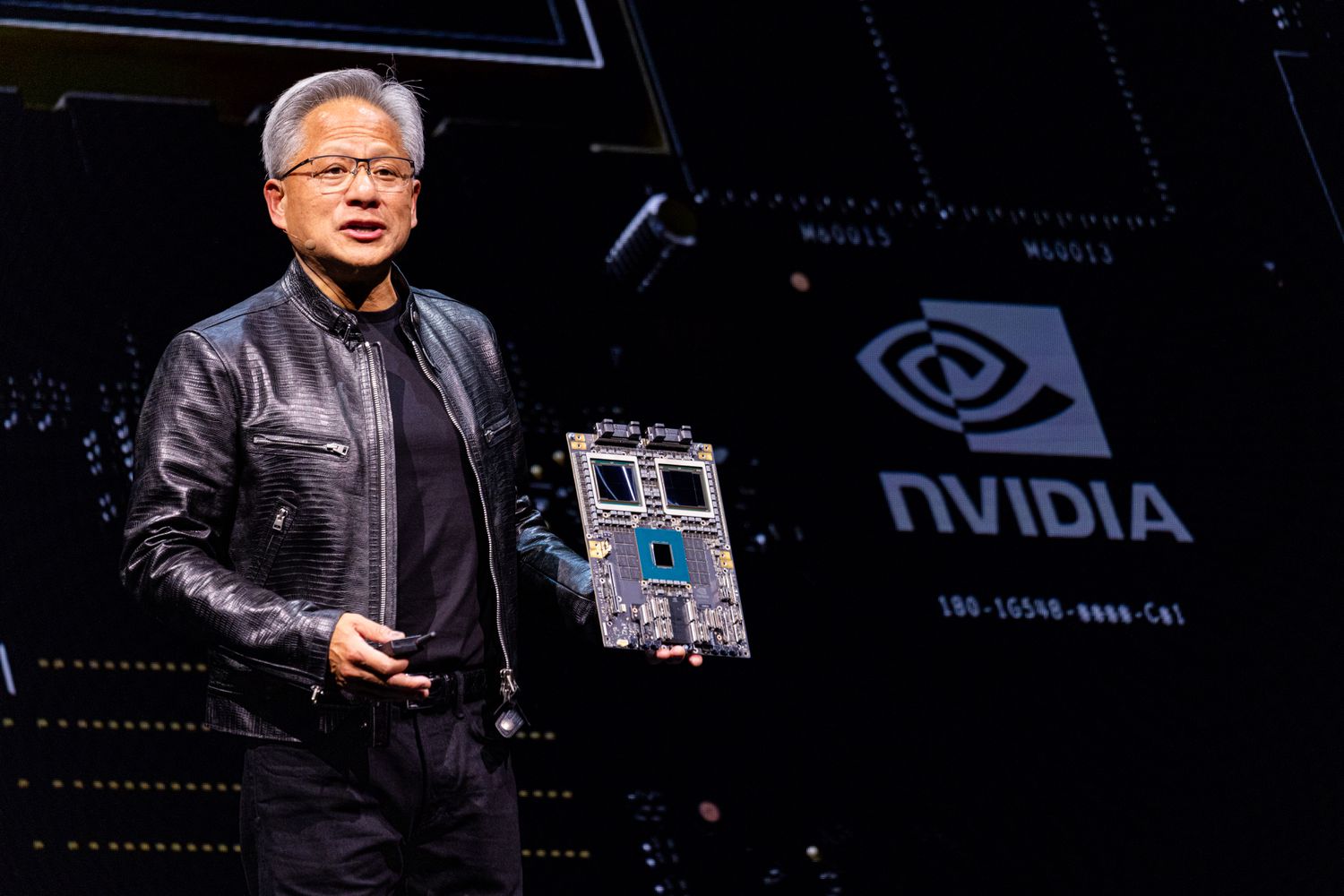

- The semiconductor giant is likely to achieve a new quarterly sales record driven by robust demand for its innovative chips.

- Market analysts hold a highly positive outlook on the AI chipmaker’s shares, with nearly all but one of the analysts monitored by Visible Alpha providing a “buy” or a similar recommendation.

Nvidia (NVDA) is poised to disclose its fourth-quarter results after markets close on Wednesday. Industry experts have expressed strong optimism regarding the stock of the AI chip manufacturer.

Among the 18 analysts analyzing Nvidia’s stock, all but one have assigned a “buy” or comparable rating, with a single individual opting for a “hold” assessment. The consensus price target sits around $175, suggesting a potential upside of about 26% from the trading price last Friday.

Analysts from Wedbush and Oppenheimer reiterated their $175 price targets on Thursday, citing soaring demand for the company’s cutting-edge chips as major tech companies increase investments in AI infrastructure. This trend is expected to contribute to another strong fiscal quarter.

According to projections by Visible Alpha, Nvidia is expected to report record-breaking quarterly revenue of $38.32 billion, representing a 73% increase year-over-year. Anticipated net income is $21.08 billion, up from $12.84 billion the previous year.

Analysts from UBS, who maintained a price target of $185, remarked that “investor expectations have risen somewhat recently” and noted that improvements in the supply chain could lead to higher sales of Nvidia’s Blackwell product line. UBS has nearly doubled its prediction for Blackwell’s contribution to fourth-quarter revenue, now estimating it to be $9 billion, up from a previous $5 billion.

Oppenheimer also commented on the rapid ascent of the Chinese AI startup DeepSeek, suggesting that this may ultimately be beneficial for Nvidia, as intensified competition compels its American clients to bolster their AI initiatives rather than retreat.

Despite a recent dip linked to DeepSeek’s impact on Big Tech’s AI expenditures, Nvidia’s stock has appreciated by approximately 75% over the past year, trading at $139.11 during intraday sessions on Friday.