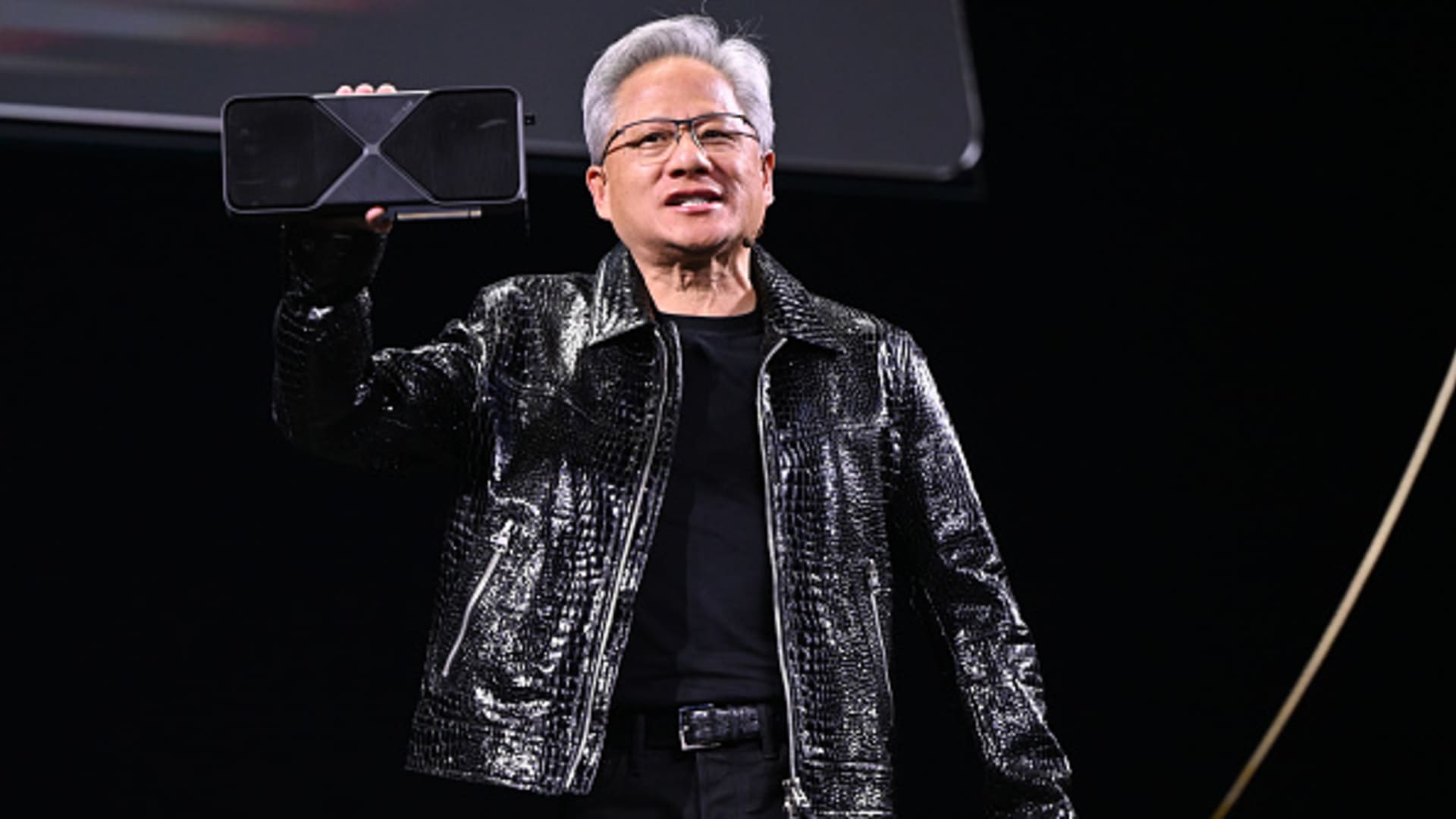

Nvidia’s CEO, Jensen Huang, captivated the audience during his keynote speech at the 2025 Consumer Electronics Show (CES) held in Las Vegas, Nevada, on January 6, 2025, where he unveiled the company’s groundbreaking innovations.

Artur Widak | Anadolu | Getty Images

In a remarkable financial performance, Nvidia’s revenue more than doubled in 2024 compared to the previous year, exceeding analysts’ forecasts. The company anticipates that sales for the upcoming quarter will continue to outpace Wall Street projections.

A significant factor driving this growth is Nvidia’s new Blackwell artificial intelligence chip, which has attracted substantial investments from major technology companies. Additionally, the chipmaker addressed concerns regarding its DeepSeek project, asserting that while AI models are becoming more efficient, they will still demand significant processing power in the long run.

Consumer sentiment, as reflected in surveys from the Consumer Board and the University of Michigan, indicates growing anxiety over the economy and inflation, contributing to a shift in investor behavior.

This shift has led to an inverted yield curve, wherein the 10-year Treasury yield fell below that of the 3-month note—a traditional indicator suggesting a potential recession within the next 18 months.

Despite Nvidia’s booming revenue and continued investment from Big Tech, overall confidence in the U.S. economy appears to be fragile. The ability of the tech sector to stabilize market sentiment remains uncertain.

Key Updates of the Day

Nvidia Exceeds Expectations with Optimistic Outlook

Nvidia released its fourth-quarter earnings on Wednesday, demonstrating significant gains that surpassed Wall Street’s expectations. Their net income for the quarter surged to $22.09 billion, marking an 80% increase from $12.29 billion during the same time last year, with quarterly revenue rising by 78%. Nvidia also provided a forecast for the current quarter that exceeds LSEG estimates. However, shares dipped by 1.5% in after-hours trading due to a noted slowdown in growth. Nevertheless, CEO Jensen Huang expressed confidence that the next wave of AI development will necessitate 100 times more computing power than previous versions.

S&P 500 and Nasdaq End Losing Streak

The S&P 500 and Nasdaq Composite ended their four-day downward trend on Wednesday, with the S&P 500 rising 0.01% and the Nasdaq gaining 0.26%. In contrast, the Dow Jones Industrial Average fell by 0.43%. Markets in the Asia-Pacific region showed mixed results on Thursday, with Japan’s Nikkei 225 increasing by 0.3%. However, shares of Seven & i dropped as much as 12% after it was revealed that the founding family could not secure the necessary financing for a buyout of the convenience store chain.

Economic Updates from China’s Annual Meeting

China is set to commence its annual legislative session, known colloquially as the “Two Sessions,” starting Tuesday. Analysts predict that at the opening session, Beijing will propose to reduce its target for yearly consumer price inflation to around 2%, a decrease from prior targets of 3% or higher. Additionally, there is speculation that China may increase its budget deficit to facilitate meaningful stimulus measures.

Inverted Yield Curve in the U.S.

The 10-year Treasury yield fell below the yield of the 3-month note during Wednesday’s trading session, resulting in an “inverted yield curve.” This phenomenon is recognized as a reliable predictor of recessions. The New York Fed provides regular updates on the relationship between the yield curve and recession probabilities over the upcoming year.

[PRO] Nvidia’s Earnings Set to Influence Markets

According to Goldman Sachs, Nvidia’s earnings release is expected to significantly impact the stock market over the following days. There are two primary reasons for this heightened influence.

In Other News…

Elon Musk, the CEO of Tesla, has decided to postpone his anticipated visit to India this week, where he was scheduled to meet with Prime Minister Narendra Modi, due to “heavy obligations with Tesla.”

Anadolu | Anadolu | Getty Images

India Seeks Tesla to Establish Manufacturing Presence

India is eager for Tesla to set up a manufacturing hub in the country, and although the electric vehicle maker has been hesitant, it has recently shown interest in expanding into the Indian market. This is coinciding with the Indian government’s efforts to attract Tesla by rolling out a new electric vehicle tariff policy.

The government introduced an EV policy last year aimed at reducing import duties on electric vehicles from approximately 70% to 15%. The initiative is expected to start accepting applications by the end of March, signaling India’s commitment to facilitating Tesla’s business operations. According to Ammar Master, South Asia Director of Automotive at GlobalData, this policy illustrates India’s readiness to support electric vehicle manufacturing.