(Bloomberg) — Thursday saw a modest uptick in Asian stock markets as investors evaluated the latest tariff updates from US President Donald Trump, while Nvidia Corp.’s earnings report fell short of expectations.

Top Stories from Bloomberg

Markets in Australia, Hong Kong, and Japan experienced gains, whereas South Korean stocks declined. Chinese equities exhibited volatility in early trading, with a regional index climbing for the second consecutive day.

Futures for the S&P 500 and Nasdaq 100 remained stable following slight increases in both indices on Wednesday. Nvidia’s shares dropped in after-hours trading after the chipmaker reported solid but not overwhelmingly impressive quarterly results, leaving some investors feeling let down.

On Wednesday, Trump announced a new 25% tariff on imports from the European Union, reiterating that previously disclosed tariffs on Mexico and Canada will take effect on April 2. However, his mixed messages created uncertainty among investors.

These tariff developments have reverberated through currency markets, boosting the dollar while curbing the decline of the Canadian dollar and Mexican peso. This has added to the volatility that has affected both equities and cryptocurrencies throughout the week.

Recent studies indicate that Trump’s new tariffs on Chinese imports may have a more pronounced impact on the US economy than the official trade data suggests.

“Conflicting statements from the administration regarding the timing and scope of these tariffs are keeping investors cautious,” noted Marvin Loh from State Street. “The ongoing discussion revolves around whether the president will delay and dilute his plans once again, or if this marks the beginning of a more aggressive approach.”

US Treasury yields decreased after a rally on Wednesday that pushed the 10-year yield to its lowest point since mid-December. The dollar index maintained its gains from the previous day, while Australian yields also fell early Thursday.

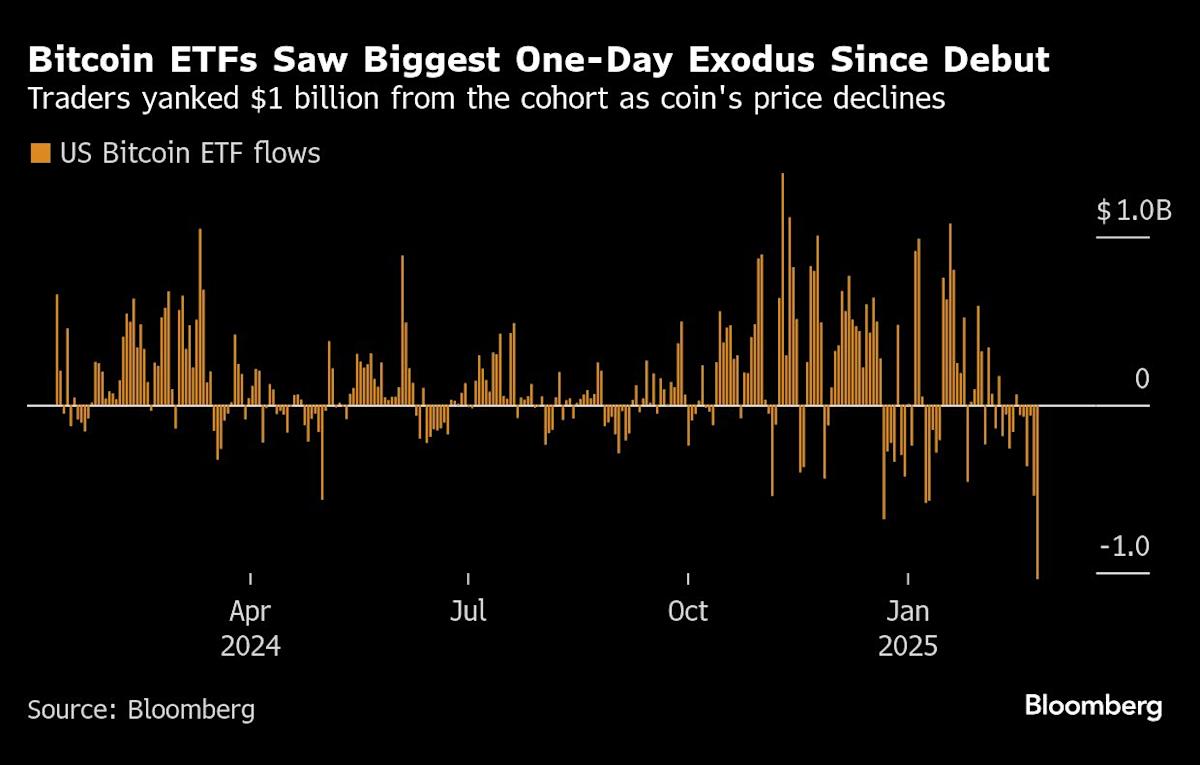

Bitcoin slipped to around $84,000, marking over a 20% decline from its peak last month, exacerbated by outflows from exchange-traded funds. Oil prices dropped, whereas gold remained stable.

In Asian markets, the yen traded around 149 per dollar, after a relatively stable close on Wednesday. Japan’s chief currency official indicated he has no reservations about the growing market expectations for a Bank of Japan interest rate increase, which contributed to a four-month high for the yen earlier this week.