Overview

Nvidia presented its inaugural financial report of the year on Wednesday, featuring much-anticipated earnings results that indicate how the company may navigate the challenges arising from the release of the less tech-focused DeepSeek AI model from China. This situation resulted in Nvidia experiencing the largest single-day loss in market value in stock market history last month.

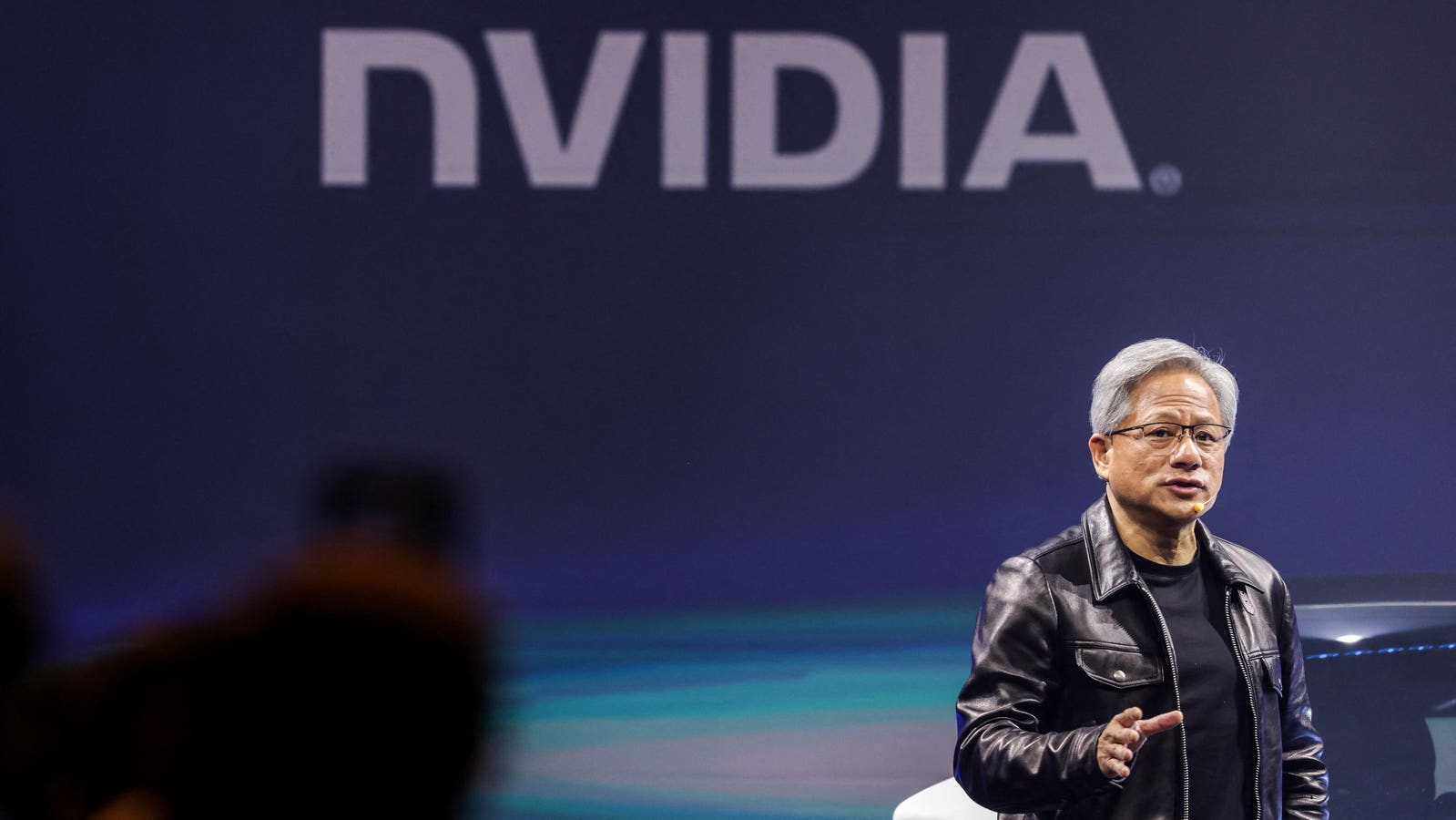

Jensen Huang, Nvidia’s CEO and co-founder, is a centibillionaire.

Important Highlights

In its fourth fiscal quarter, which concluded last month, Nvidia announced revenues of $39.3 billion, with adjusted earnings per share of $0.89 and a net income of $22.1 billion. This marks a significant year-over-year revenue growth of 78% and an impressive profit growth of 71%.

Market analysts had estimated Nvidia’s revenue to reach $38.1 billion, with adjusted earnings per share of $0.85 and a net income of $19.6 billion, according to data from FactSet.

Nvidia’s datacenter division, which includes the graphics processing units (GPUs) that support most generative AI applications, reported sales of $35.6 billion, exceeding predictions of $33.5 billion.

The company anticipates revenues of approximately $43 billion for the upcoming spring quarter, subject to a 2% margin of error, surpassing Wall Street’s expectations of $42.7 billion.

During the earnings announcement, CEO Jensen Huang described the demand for the company’s Blackwell GPU system, released late last year, as “incredible.”

Despite surpassing expectations across the board, Nvidia’s stock saw a slight decline in after-hours trading, possibly due to lower gross profit margins. CFO Colette Kress attributed this shift to “a transition to more complex and higher-cost systems” within the datacenter sector.

Additional Insights

The growth in Nvidia’s top and bottom lines was the slowest since the quarter ended in April 2023. However, it remains robust, especially when compared to the modest 4% revenue and 10% profit growth reported by Apple, which is the only company above Nvidia in market capitalization.

Significant Figure

$72.9 billion: This amount represents Nvidia’s net profit for the fiscal year that ended last month, reflecting a remarkable 145% increase from the previous year. Compared to the fiscal year ending January 2023, this marks an astounding 875% growth driven by the surge in AI demand.

Nvidia Stock Fluctuated Before Earnings Report

Nvidia’s shares saw nearly a 4% increase during regular trading on Wednesday, closing at $131.28. However, the company, with a market cap of $3.2 trillion, recorded its lowest intraday share price since February 3 on Tuesday following a rough start to the week, dropping approximately 3% on both Monday and Tuesday. The decline this week can be attributed to broader investor concerns regarding uncertainties from President Donald Trump’s economic policies; the Nasdaq index fell over 1% on both days, reaching its lowest point since late November. Ahead of the earnings report, Nvidia was trading about 10% lower than its position prior to its most recent report in November, even with the uptick on Wednesday. Additionally, shares have declined nearly 10% over the past month in response to the DeepSeek selloff, as the market equipped worries that high-performing generative AI models, which can operate with less of Nvidia’s costly semiconductor technologies, may adversely affect sales. According to analysts at Wedbush led by Dan Ives, the earnings announcement was a significant stress test for a shaky market, with perceptions currently leaning heavily negative.

Analyst Outlook

As Nvidia moved closer to its earnings release, analysts showed considerable optimism regarding the stock despite recent fluctuations. The average price target of $175 among the 68 analysts monitored by FactSet indicates a potential upside of 38% from Tuesday’s share price. Bank of America analysts, led by Vivek Arya, noted that Wednesday’s earnings call “could signal a turning point in investor sentiment,” and they are some of the most optimistic Nvidia advocates on Wall Street, with a price target set at $190.

Background Information

Nvidia, based in California, has emerged as a central figure in the current AI revolution as the leading designer of technology essential for training large language models. Morgan Stanley analysts predict Nvidia will command approximately 95% of the global GPU market, projected to be worth $158 billion by 2025. Its commanding market presence has propelled Nvidia’s stock to unprecedented heights, and it was recognized as the best–performing stock in the S&P 500 for the years 2023 and 2024. Nonetheless, Nvidia’s recent performance has lagged behind broader market trends, having gained just 3.7% over the past six months, compared to the S&P 500’s 6.7% return. Jensen Huang, the 13th-richest individual globally, downplayed the market’s negative response to the DeepSeek release, asserting last week that the notion of reduced AI investments is “the complete opposite” of reality.

Explore More