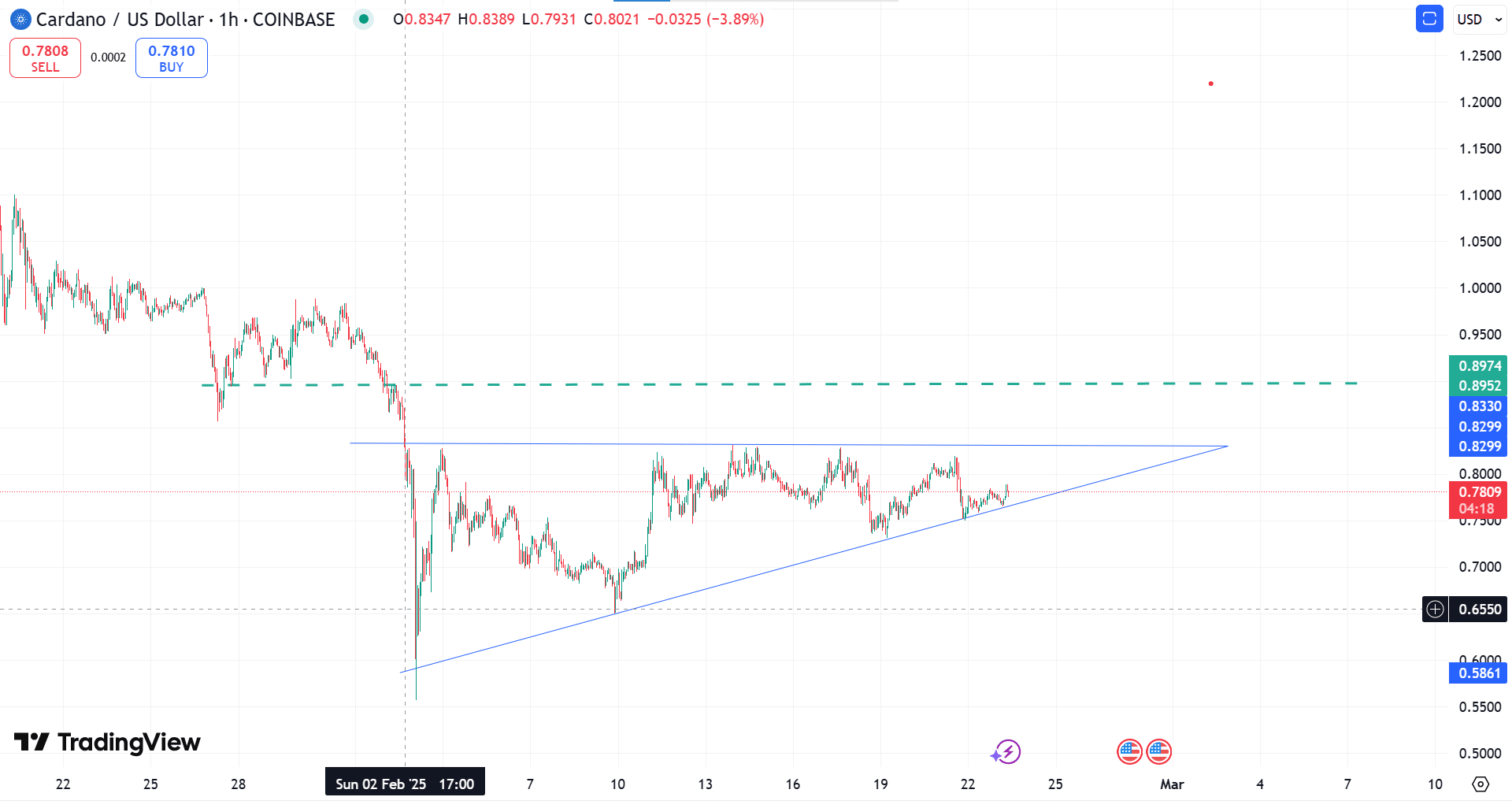

- The developing ascending triangle on Cardano indicates a potential increase in investor accumulation, raising the likelihood of a bullish breakout.

- Growing Open Interest, alongside heightened network activity and positive market sentiment, points to increased engagement from market participants.

Cardano [ADA] appears poised for a significant price recovery after a challenging period marked by short selling.

Despite recent selling pressure, ADA’s current ascent within the ascending triangle pattern signifies a shift in market sentiment as buyers step in.

The coin’s consistent bullish trend and increased market participation suggest a potential breakout above the crucial resistance level of $0.83.

As of this report, ADA was priced at $0.7809, reflecting a 1.08% increase even with a decrease in trading volume over the past 24 hours, according to CoinMarketCap.

Market Sentiment and On-Chain Indicators

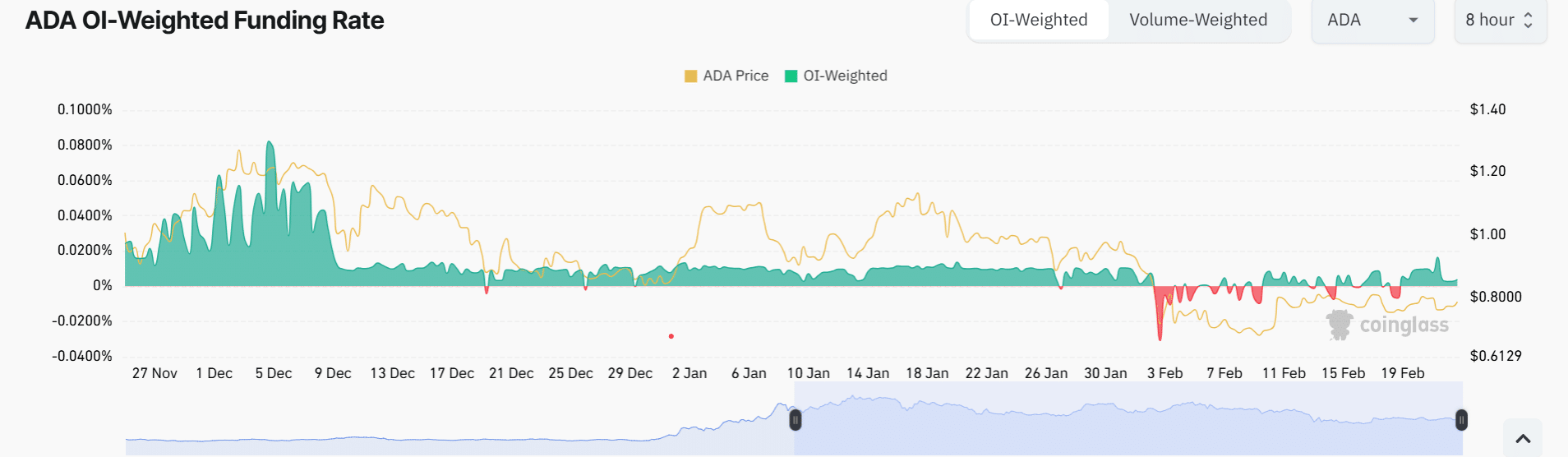

In the last 24 hours, Cardano’s Open Interest has risen by 2.09%, with its long-short ratio reaching a neutral status of 0.92, indicating that traders are entering positions, based on data from Coinglass.

The Weighted Funding Rate for ADA has also turned positive due to increasing demand for long positions.

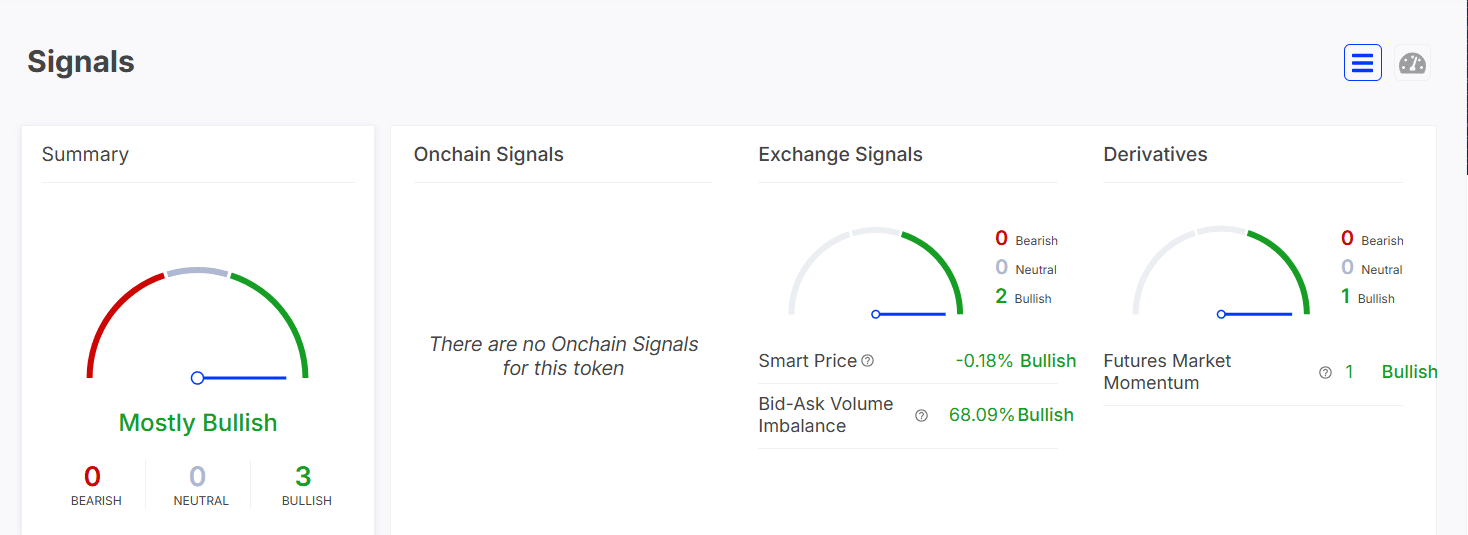

According to data from IntoTheBlock, the bid-ask volume was at 68.09%, with predominantly bullish signals from exchanges indicating investor accumulation, which enhances ADA’s likelihood of a breakout.

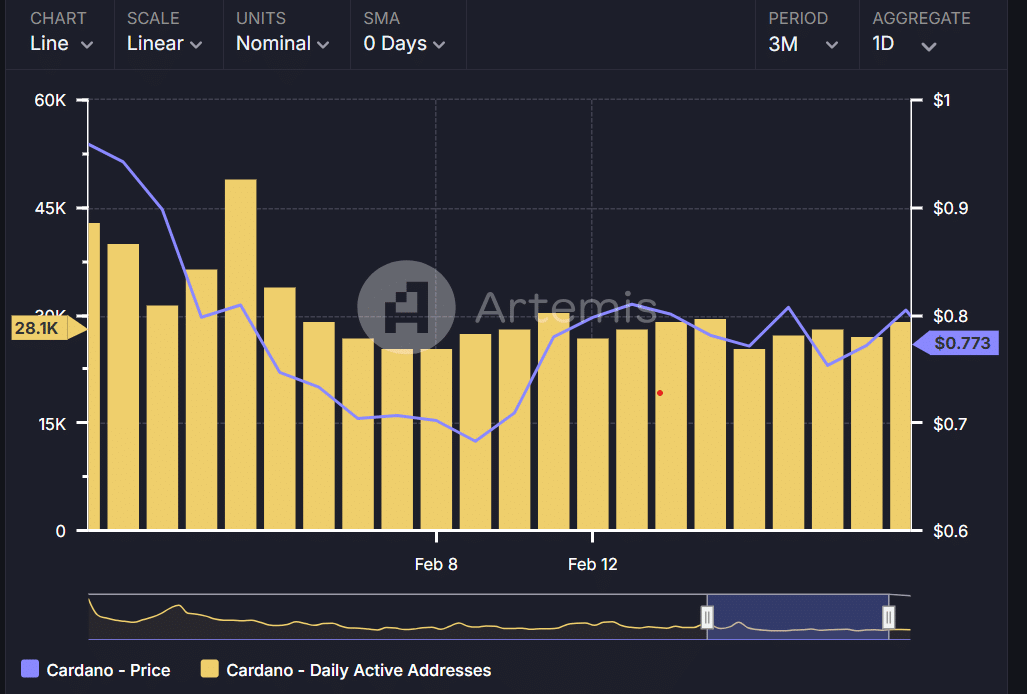

Cardano’s active network addresses have seen a gradual increase over the past 72 hours, reflecting heightened market engagement that aligns with ADA’s bullish trend observed on the hourly chart.

Cardano’s Recovery and Possible Breakout

Analyzing Cardano’s technical situation, ADA is showing higher lows within an ascending triangle, indicating active accumulation.

If the bullish trend persists, a breakout beyond the $0.83 resistance level may occur.

With strong buying interest, ADA could potentially rise to the key resistance zone of $0.90 before challenging the $1.00 psychological mark.

Future Outlook for Cardano

The Exponential Moving Average (EMA 200) for ADA stands at $0.7301, while the Simple Moving Average (SMA 200) is at $0.6547, both beneath the current price, signaling strong buy potential and confirming long-term bullish momentum, according to data from TradingView.

The Relative Strength Index (RSI) is currently at 44, indicating that Cardano may be slightly oversold and is in a recovery phase post-bear market.

Consequently, Cardano could experience increased buying pressure in the upcoming days, enhancing its bullish momentum and potential for a breakout.