- NEAR is currently at a pivotal point on the chart, as it strives to regain a support level that could influence its potential upward movement.

- On-chain data reflects a mix of market signals, putting NEAR at a critical juncture for its next steps.

Near Protocol [NEAR] has faced a 3.80% decline in the last 24 hours, with its price at $3.38 as of this writing.

This drop continues the downward trajectory NEAR has been experiencing recently, marking a significant 36.94% decrease over the past month.

Market analysis reveals conflicting signals, which may hinder a potential recovery or lead to further declines.

NEAR’s Efforts to Reclaim Higher Levels

After spending the previous month within a consolidation range—fluctuating between a support level at $3.50 and a resistance point at $8.30—NEAR has recently broken through this support and has been trending downward.

However, as of this moment, the asset is making efforts to regain that support, returning within the consolidation range and forming a new high.

This recent price adjustment might be a lower high formation for NEAR ahead of a continued downward trend.

AMBCrypto analyzed further aspects that could impact price trends—whether they trend upward or downward—and found a divided market sentiment.

Uncertain Market Sentiment Creates Challenges

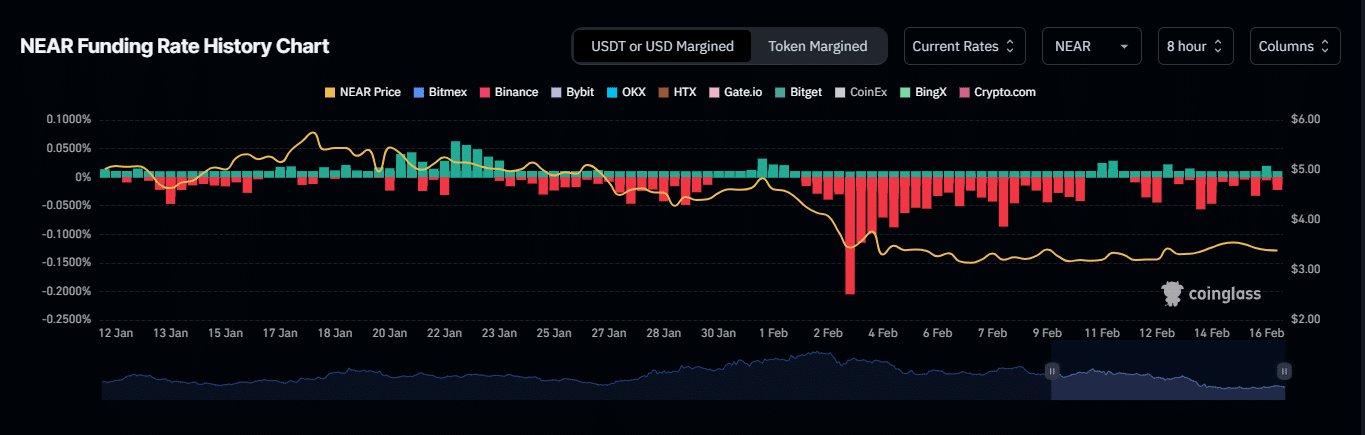

Various market indicators indicate a split sentiment in the market. As of now, the Funding Rate indicates that sellers are dominating the market.

With a negative Funding Rate of -0.0170, this suggests that sellers strongly believe NEAR’s price will decline in the near term.

Additionally, the market has seen an increase in long contract liquidations across all time frames. In just the past 24 hours, long positions worth $137,140 have been liquidated compared to $24,170 in short liquidations.

Such significant disparities indicate that bears are currently dominating NEAR, increasing the chances of continued price drops.

Despite this, the Taker Buy-Sell Ratio suggests that bulls are still active, as buying volume has outpaced selling volume in the last day.

This ratio is assessed on a scale where 1 indicates a neutral market. A value above 1 signifies active buying, while below 1 suggests seller dominance.

Currently, NEAR’s Taker Buy-Sell Ratio stands at 1.004, indicating a slightly bullish sentiment in the past 24 hours.

Decline in Active Addresses Adds Further Pressure

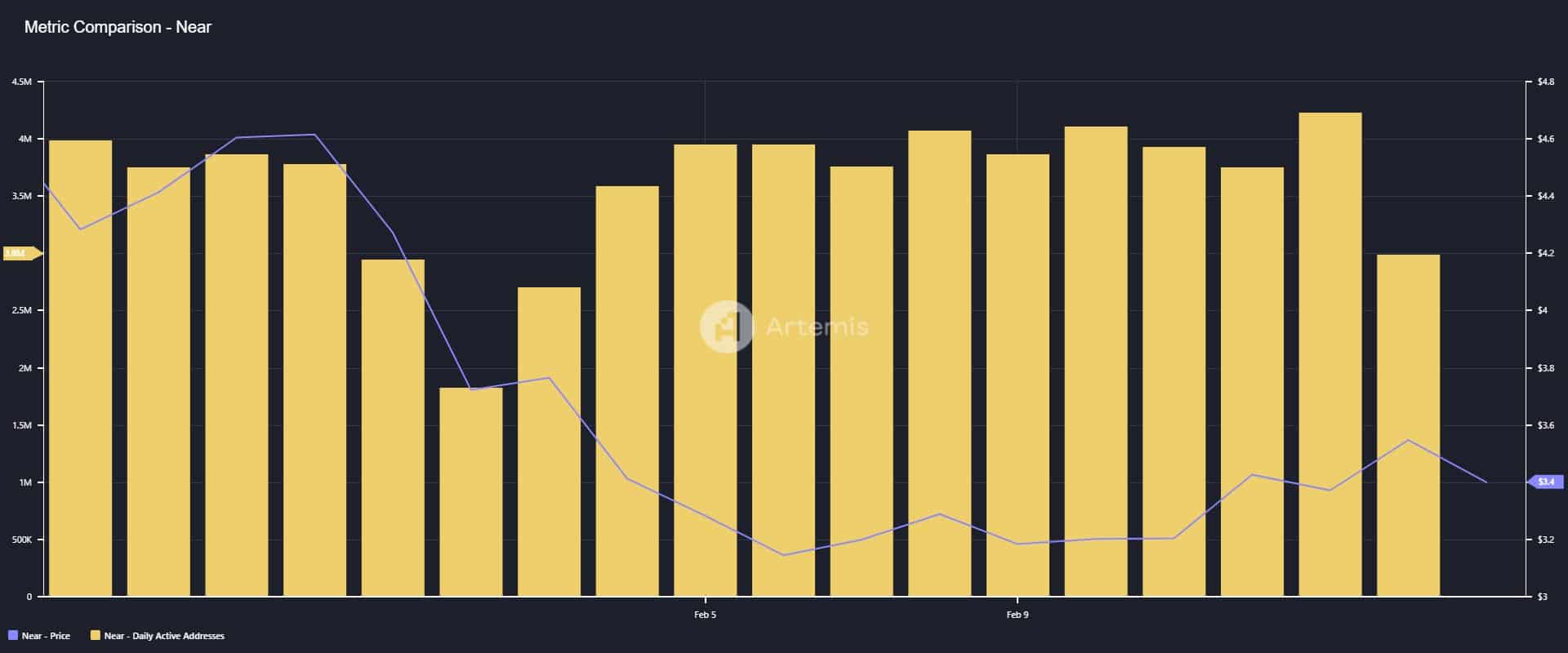

The NEAR protocol has seen a notable decrease in its Daily Active Addresses.

A decrease in active addresses during a price drop points to diminished network activity, suggesting traders may be exiting their positions.

According to Artemis, from February 13 until now, active addresses have declined by 1.2 million—from 4.2 million down to 3.0 million.

This significant reduction indicates that a considerable number of sellers are leaving the market.

Should the number of active addresses continue to fall, it might exert additional downward pressure on the asset as more sellers could flood the market.