- The recent decline in Ethereum’s transaction fees and increasing accumulation could indicate the onset of a market recovery.

- A significant drop in ETH reserves on exchanges suggests a possible supply constraint and an impending price surge.

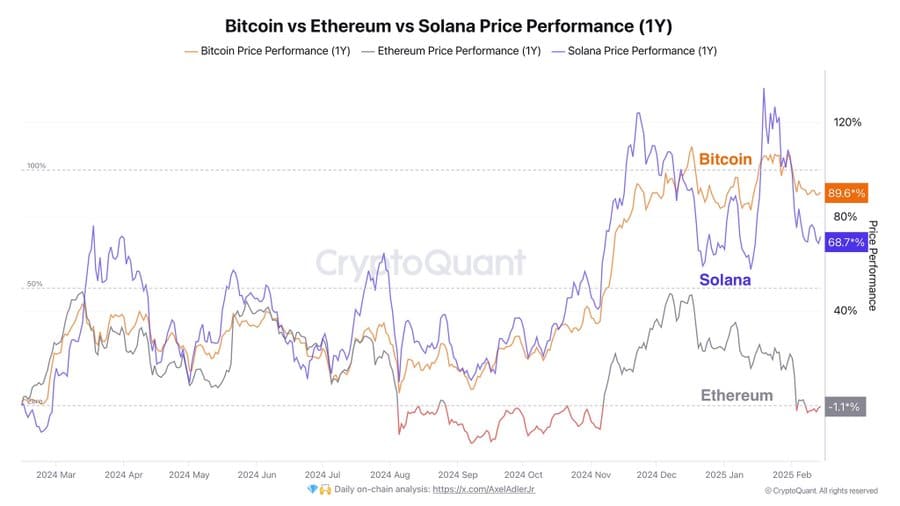

Ethereum [ETH] has been underwhelming in performance compared to its competitors for more than a year. Nonetheless, new on-chain analytics may be hinting at an upcoming change. Currently, ETH is down 1.1% year-on-year, while Bitcoin [BTC] and Solana [SOL] have seen substantial gains.

Two pivotal factors—declining transaction fees and rising accumulation—might reflect mounting confidence among investors.

Could this be the beginning of an Ethereum revival?

The Impact of Reduced Fees on Network Engagement and Adoption

This week, Ethereum’s transaction fees have plummeted by over 70%, with the total daily fees dropping to $7.5 million from $23 million just weeks earlier. This decrease follows an increase in the gas limit, which has effectively raised block capacity and alleviated congestion.

Historically, lower fees have been associated with increased network activity. For example, during previous fee reductions in 2021 and mid-2023, daily active addresses and transaction volumes saw a notable uptick.

If this trend continues, Ethereum may experience a revival in on-chain engagement. However, the key question remains: will this increase in activity lead to sustained demand or merely short-lived speculative bursts?

Could the Sudden Drop in ETH Reserves Indicate a Supply Challenge?

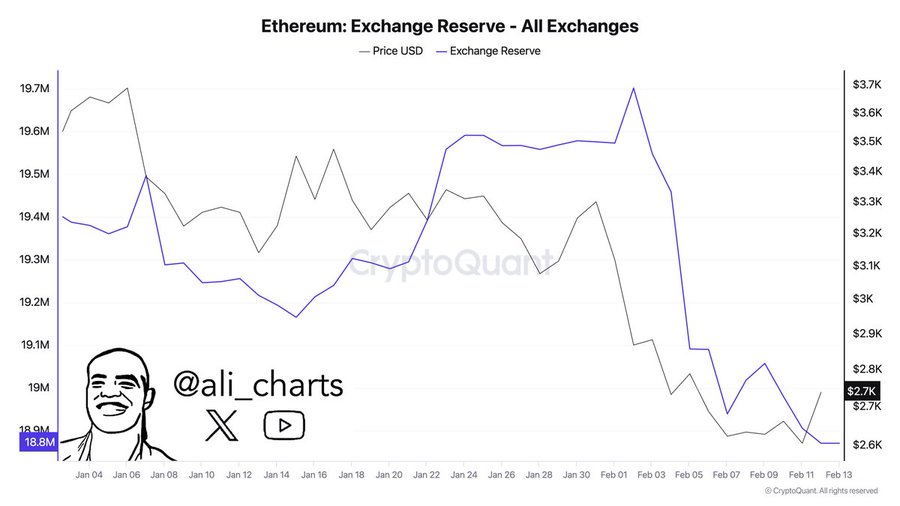

Ethereum’s reserves on exchanges have decreased significantly, falling from 19.7 million ETH in early January to 18.8 million ETH within just ten days.

Such a swift decline suggests that investors are transferring their holdings to self-custody solutions, thus reducing the immediate supply available for trading.

Historically, such sharp declines have often been precursors to price increases. The last notable drop in exchange reserves occurred in Q4 of 2023, followed by a 35% price surge in the subsequent two months.

If this price action continues, Ethereum could indeed face a supply crunch, especially if demand rebounds alongside the lower fees.

Technical Indicators Reflect a Lack of Bullish Momentum

Despite the improving metrics on-chain, as of the latest updates, Ethereum remained down 1.1% compared to the previous year, lagging behind Bitcoin (up 89.6%) and Solana (up 68.7%).

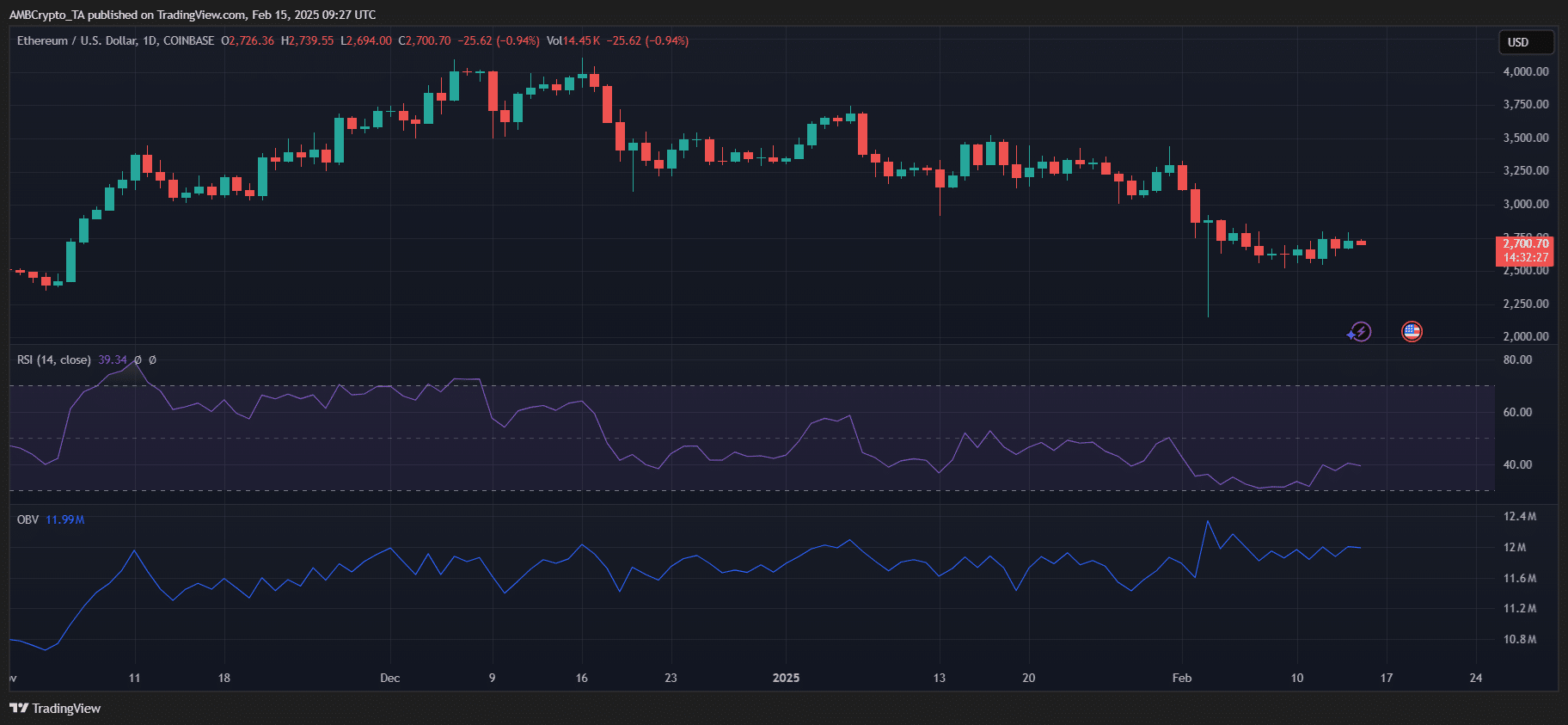

Recent analysis revealed a significant resistance level around $2,800, where ETH has struggled to break through, despite increased accumulation. The Relative Strength Index (RSI) was recorded at 39.34, suggesting that while Ethereum is nearing oversold conditions, it has yet to demonstrate bullish momentum.

Moreover, the On-Balance Volume (OBV) indicated a lack of strong buying pressure, implying that although the supply is tightening, demand has not surged yet.

For Ethereum to achieve breakout potential, it needs to decisively move past the $2,800-$2,900 range supported by increasing trading volume. Should this fail, a retest of $2,500 may occur before any meaningful upward movement takes place.