Trump Plans to Implement Tariffs on Foreign Cars Starting April 2

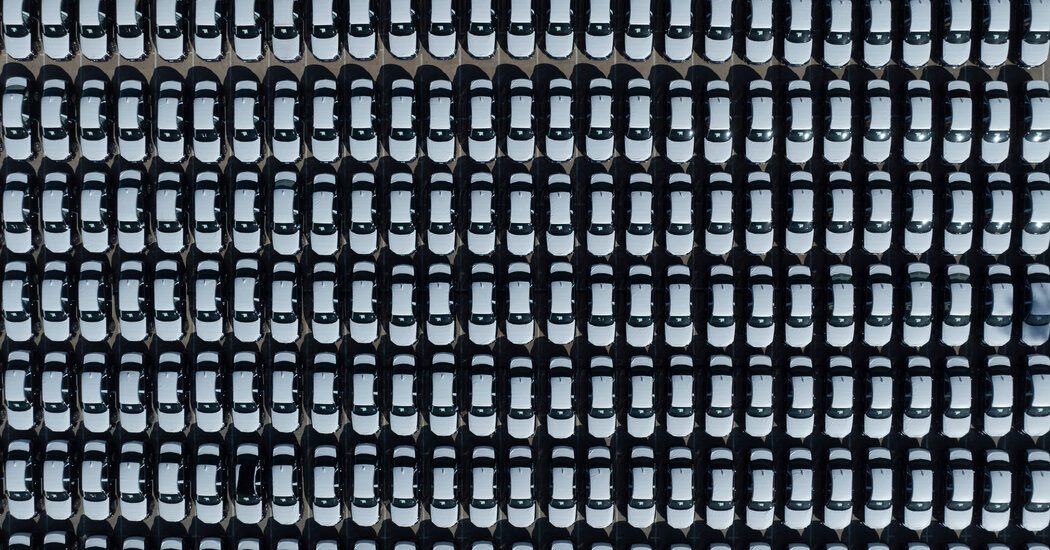

On Friday, President Trump announced intentions to proceed with tariffs on foreign automobiles, set to take effect on April 2. However, he did not disclose the specific percentage of these tariffs or which countries will be affected.

During a discussion in the Oval Office, Mr. Trump mentioned, “maybe around April 2,” indicating he had initially considered revealing the tariffs on April 1, which coincides with April Fools’ Day, but opted against it due to a superstitious belief. He queried an adviser for confirmation, who affirmed the proposed date.

In the early days of his administration, Mr. Trump has introduced several trade initiatives that could significantly impact the automotive sector.

Upcoming Trade Measures Affecting the Auto Industry

Recently, Mr. Trump revealed plans to impose a 25% tariff on imported steel and aluminum beginning March 12, both of which are essential materials for the auto industry. Furthermore, he has proposed similar tariffs on all imports from Canada and Mexico, nations that provide critical raw materials and host manufacturing facilities for major automotive brands. Although these tariffs have been delayed until March 4 while negotiations continue concerning drug prices and immigration, an additional 10% levy on China—another key auto parts supplier—has already taken effect.

Moreover, on Thursday, the president outlined a "reciprocal tariff" strategy, instructing advisors to establish new tariffs for other nations based on their trade practices, deemed unfair by the administration. This plan may also lead to additional tariffs starting April 2. Trump specifically targeted European tariffs, which currently impose a 10% tax on American vehicles, contrasting with the U.S. tariff of 2.5% on European cars, although a significantly higher 25% tariff is charged on light pickup trucks.

Impact on Automakers and the Industry

Automakers are preparing for the potential repercussions of these tariffs, with many forecasting notable job losses in the sector. Jim Farley, CEO of Ford, expressed concerns earlier this week, stating that a 25% tariff on Canadian and Mexican goods would have devastating consequences for the U.S. auto industry, creating issues that had never been witnessed before.

With an extensive, interconnected supply chain, the automotive industry heavily relies on the exchange of billions of dollars in finished vehicles, engines, transmissions, and components crossing the U.S. borders from Canada, Mexico, and China each week.